Mirror SOLs Early Surge wake of Solana’s breakout—from a little-known altcoin to a top-tier Layer-1 blockchain—investors are hunting for the next asset with similar asymmetric upside. While no two cycles are identical, the structural forces that powered SOL—fast throughput, developer gravity, community evangelism, and relentless shipping—still define how early-stage networks break into the big leagues. This article explores how an emerging project could replicate that trajectory, which signals matter most, and how to distinguish durable momentum from fleeting hype.

To ground the discussion, imagine a hypothetical project—let’s call it Project Nova (NOVA)—that shares key design goals with prior winners without being a clone. NOVA is a stand-in, not financial advice or a guarantee. The aim is to equip you with a research lens: if you encounter a real network that looks like NOVA, you’ll know how to evaluate it. Along the way, we’ll unpack catalysts such as tokenomics, developer ecosystem incentives, DeFi liquidity, CEX listings, and on-chain usage, and we’ll explain the red flags that could derail even the flashiest launch.

Why Solana’s Early Surge Still Matters

Solana’s rise wasn’t merely a speculative wave; it was a product-market fit moment for a high-throughput smart contract chain that solved a real pain: low-latency, low-fee transactions supporting consumer-scale apps. The narrative cohered around measurable realities—transactions per second, finality, and developer velocity—so when liquidity and users arrived, the system had the capacity to keep up. That lesson matters for any new cryptocurrency aspiring to follow suit. Sustainable rallies grow from utility, not just from marketing.

The Repeatable Parts of SOL’s Playbook

Three pillars of Solana’s story are widely repeatable. First, a crisp technical edge—throughput, finality, or unique virtual machine design—can unlock new use cases. Second, a relentless shipping culture creates a cadence that markets can price. Third, early-DeFi and consumer primitives—DEXs, NFT marketplaces, and payments rails—seed a feedback loop for TVL and daily active users.

NOVA would need the same flywheel. It must be more than a whitepaper; it needs production apps where fees, settlement, and developer experience are visibly superior. If early apps on NOVA show DEX liquidity, stable staking rewards, and fluid user onboarding, the groundwork for an SOL-like run exists.

The NOVA Thesis: What Would the Next Breakout Look Like?

Imagine NOVA as a modular Layer-1 with an execution environment tailored for parallel transaction processing. It supports a popular developer language and pairs that with a robust toolkit—indexers, SDKs, and local devnets—that compresses build time from weeks to days. Its design embraces account abstraction for seamless wallets, allowing social sign-ins and gas sponsorship. Instead of novelty for novelty’s sake, NOVA’s core breakthrough is practical: it makes building and using crypto apps feel like any smooth mobile app.

The Feature Stack That Could Matter

A credible rival to SOL’s early surge would likely foreground end-user experience. NOVA’s roadmap might prioritize sub-second finality and low, predictably priced fees, even during peak hours. It would also invest in security audits, formal verification options, and structured bug bounties. By limiting “unknown unknowns,” NOVA can avoid the headline risk that undermines momentum.

Beyond performance, NOVA would emphasize cross-chain reach with native bridges and canonical routings to top ecosystems. Out-of-the-box integrations with stablecoins, oracles, and leading DeFi primitives would let liquidity arrive on day one. The goal is to ensure that when attention spikes—whether due to an airdrop, an IDO, or a viral consumer app—users don’t hit friction.

Tokenomics: The Silent Engine Behind Price Trajectories

When investors say a new cryptocurrency “feels like SOL,” they’re usually responding to token design as much as technology. Tokenomics shapes supply and demand through emission schedules, vesting, unlock calendars, staking yields, and governance rights. Projects that surge sustainably tend to keep their fully diluted valuation (FDV) in line with near-term utility, and they minimize surprise unlocks that swamp buyers.

Designing for Sustainable Demand

NOVA’s tokenomics would align early incentives with long-term network health. A moderate initial float prevents price manipulation while keeping market cap reasonable. Transparent vesting for team and investor allocations reduces uncertainty; unlocks can be paired with growth milestones to signal confidence. Staking yields should be attractive but not inflationary—ideally balancing staking rewards with real fee burn or value capture from network usage.

Crucially, the token must do real work. If NOVA’s token is necessary for gas, governance, and collateral within DeFi, it gains multiple demand vectors. If it accrues a portion of MEV rebates, priority fees, or protocol revenues, that strengthens the investment case without turning it into a quasi-security. The watchword is utility: the more ways users and builders employ the token, the sturdier the price foundation.

Developer Gravity: The #1 Leading Indicator

Price follows usage, and usage follows builders. The best early signal of an SOL-like surge is a swelling developer base. Count hackathon registrations, SDK downloads, and GitHub active repos; track attendance at dev calls; and watch for respected teams migrating flagship products. A handful of credible launches—a performant DEX, a robust lending protocol, a sticky perps exchange, and a creator-friendly NFT platform—can ignite the flywheel.

Grants, Tooling, and Onboarding

NOVA’s foundation could catalyze growth via targeted ecosystem grants, structured incubators, and partnerships with established service providers. But cheques alone don’t create usage; builders need smooth deploys. The real unlock is opinionated tooling: reference implementations, composable templates, and a “gold path” for app deployment that goes from local to mainnet in hours. A well-lit path can turn curious devs into production teams, and production teams into magnets for users.

Liquidity and Listings: From DEX Pools to Tier-1 CEXs

A new Mirror SOLs Early Surge often lives or dies by liquidity. If early buyers can’t get in or out at fair prices, momentum stalls and trolls flood the discourse. That’s why launch day DEX pools, AMM incentives, and market-making are more than optics; they’re infrastructure for price discovery.

DEX First, CEX Soon After

If NOVA’s rollout mirrors strong precedents, it would launch with deep pools on a flagship DEX, a transparent IDO or fair auction, and clear incentives for LPs. At the same time, it would prepare for CEX listings, ensuring compliance, custody support, and risk controls are ready. When reputable exchanges list a token, more conservative capital can engage, broadening demand and stabilizing the order book. This sequencing—DEX first, then CEX—lets genuine price discovery lead the narrative while opening the door to institutional participation later.

On-Chain Metrics That Separate Signal from Noise

During SOL’s rise, the market obsessed over TVL, daily active addresses, transactions, fee revenue, and validator counts. The same dashboards matter today, but they should be read in context. A network can inflate raw transaction counts with meaningless spam. Conversely, a modest TVL can mask sticky engagement in consumer apps where value doesn’t sit idle.

What to Track in the First 90 Days

For a NOVA-like opportunity, focus on quality-adjusted activity. Are active addresses transacting across multiple dApps, or just claiming airdrop rewards? Do median fees and time-to-finality remain stable during traffic surges? Is DEX volume rising in tandem with the number of unique traders? Are NFT mints coupled with secondary sales and social traction, or are they vanity drops?

Validator decentralization is another pillar. A growing, geographically distributed set of validators, healthy stake distribution, and meaningful penalties for downtime all signal resilience. If node requirements are efficient enough for modest hardware, grassroots operators can participate, increasing the network’s security and legitimacy.

Narrative: The Most Underrated Catalyst

Technology attracts developers; narratives attract the world. SOL’s cultural moment fused speed with consumer ambition—NFTs, payments, and mobile-friendly experiences. The next breakout cryptocurrency will own a similar narrative that is specific and falsifiable. NOVA’s story, for instance, could be “the chain that makes consumer crypto invisible,” where wallets melt into app flows and fees are forgettable. That story is powerful because it can be tested quickly: do users feel it?

Media, Memes, and Measurables

Narrative doesn’t mean spin. It’s the shortest sentence that describes tangible progress. The more NOVA’s community can connect memes to measurables—“sub-second finality,” “one-click onramps,” “gasless sponsorships”—the more durable the attention. Communities that ship and show constantly outgrow communities that promise and postpone.

Risk, Reality, and Responsible Position Sizing

None of this removes risk. The road to an SOL-like surge is littered with near-misses and clever designs that never escaped the lab. Smart contracts carry exploit risk; bridges can be compromised; tokenomics can misfire; and macro conditions can drown even the best launches. The antidote is humility and a robust research stack.

A Practical Framework for Due Diligence

Before committing capital to any new cryptocurrency, reconstruct a checklist. Read the whitepaper for clarity, not complexity. Verify testnet-to-mainnet progression and the cadence of upgrades. Examine vesting schedules and insider allocations. Look for independent security reviews and audits. Interview the community—Discord, dev calls, GitHub—rather than relying solely on polished threads. Finally, size positions according to risk tolerance, defining invalidation points before emotions take the wheel.

Could NOVA Actually Replicate SOL’s Early Surge?

The honest answer is “possibly—under strict conditions.” If NOVA combines practical performance with elegant developer tooling, if it lands early flagship apps, and if its tokenomics avoid supply shocks, the table is set. Add disciplined liquidity, swift CEX listings, and a narrative that resonates beyond crypto-native circles, and the market could reward it with a reflexive loop of price and attention.

The Path from Curiosity to Conviction

Conviction grows as hypotheses survive reality. Start by tracking NOVA’s first month for throughput under load, stability of fees, and developer shipping. In month two, gauge whether early DeFi and consumer apps retain users and deepen liquidity. By month three, observe whether partnerships, ecosystem grants, and cross-chain integrations arrive on schedule. If each milestone tightens the feedback loop—usage begets liquidity, liquidity begets listings, listings beget new users—the resemblance to SOL’s early arc becomes more than cosmetic.

Positioning for Asymmetric Upside Without Overreach

Early-stage altcoins can multiply portfolios or crater them. The trick is to capture optionality without courting ruin. Stagger entries around events—testnet completions, mainnet launch, airdrop distributions, and early integrations—rather than chasing wicks. Consider splitting capital across the token and key ecosystem plays—DEX tokens, infrastructure providers, indexers—that stand to benefit from NOVA’s growth even if the base token is volatile.

Staking, Governance, and Participation

One of the underappreciated benefits of nascent networks is that non-price participation can be lucrative. Running a validator or delegating to high-uptime operators may earn stable staking rewards that compound over time, assuming slashing risk is managed. Active governance participants can shape parameters that directly impact the network’s economic design. In some cases, early community work earns retroactive grants or allocations, further aligning contributors with the network’s upside.

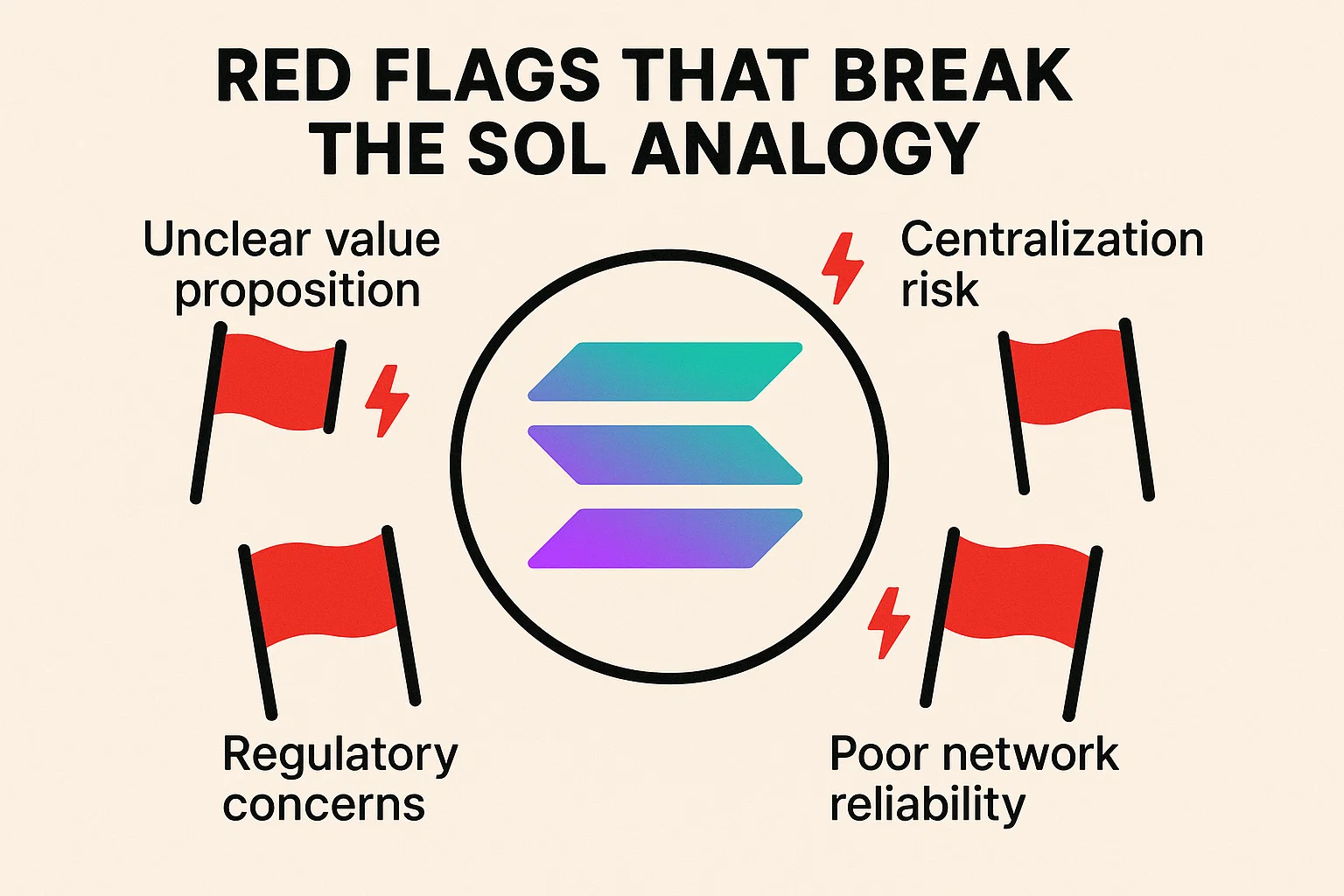

Red Flags That Break the SOL Analogy

Not every fast chain is a future SOL. Beware of projects that trumpet theoretical TPS without production evidence, or that flood social feeds with marketing while GitHub sits idle. If FDV launches at a level that implies perfection long before traction exists, prudence dictates patience. Concentrated insider allocations, opaque vesting mechanics, or moving technical goalposts are all signs to reassess.

Learning to Say “Pass”

Great investors are defined as much by the passes as the buys. If NOVA—or any new cryptocurrency—can’t show testable claims, credible builders, and defensible tokenomics, accept that opportunity cost is a cost worth paying. In a market that never runs out of shiny objects, discipline is alpha.

Putting It All Together

Sustainable surges start with substance. The next SOL-like run will belong to a chain that makes real users forget they’re on-chain. It will combine a clear technical edge with builder joy, encode investor-friendly tokenomics, seed early DeFi and consumer demand, and let narrative trail facts. If you track those ingredients—and ignore noise—the odds of catching the next big arc improve dramatically.

What to Do Tomorrow Morning

Pick three metrics to watch: developer velocity, user retention in two or three flagship apps, and the slope of liquidity across DEXs. Read the audits, skim the code, and sit in a dev call. Size your exposure so that a wrong bet stings but doesn’t scar. And remember that every cycle anoints fresh leaders precisely because they build what the last cycle forgot.

Conclusion

A new cryptocurrency can echo SOL’s early surge, but not by copy-pasting slogans. It needs practical performance, clean tokenomics, genuine developer gravity, disciplined liquidity, and a narrative that compresses its advantages into a sentence the world can test. If a project like NOVA emerges with those traits, the ingredients for asymmetric upside are in place. Your edge won’t be clairvoyance—it will be process: tracking the right metrics, separating measurable progress from hype, and sizing positions with respect for risk. Do that consistently, and when the next breakout arrives, you’ll recognize it before the crowd does.

FAQs

Q: How do I tell if a new cryptocurrency has real utility or just hype?

Start with measurable usage. Look for active addresses engaging across multiple dApps, stable fees under stress, growing DEX volume, and healthy developer activity. Confirm audits and see if flagship apps solve clear problems rather than running vanity demos.

Q: What’s the difference between market cap and FDV, and why does it matter?

Market cap equals circulating supply times price, while fully diluted valuation (FDV) uses total supply. A massive FDV at launch can suppress upside if unlocks flood supply. Reasonable FDV aligned with adoption milestones reduces surprise dilution.

Q: Are CEX listings necessary if the token already trades on DEXs?

DEX liquidity is essential for early price discovery, but reputable CEX listings expand reach to institutional and retail investors who prefer custodial venues. The combination deepens order books and can improve price stability.

Q: What tokenomics features support sustainable growth?

Transparent vesting, moderate emissions, genuine staking rewards, and real token utility—gas, collateral, and governance—are constructive. Value capture aligned with usage (priority fees, MEV rebates, or protocol revenues) strengthens the long-term case.

Q: What risks could derail a project that looks promising at launch?

Contract exploits, bridge vulnerabilities, weak validator sets, spammy or fake activity, and macro shocks can all undermine momentum. Overly aggressive tokenomics and opaque governance add avoidable risk. Diversification and modest sizing help mitigate the downside.

Read more: Bithumb Lists $AERO and $SOLV A New Era for Crypto Trading