The Bitcoin buying spree isn’t slowing down. With Strategy reportedly adding another 397 BTC, investors are reminded that corporate and institutional demand has become a durable trend rather than a passing headline. Whether you lean long-term or actively trade, understanding the mechanics and implications of a Bitcoin buying spree can help you build conviction, manage risk, and avoid emotional moves. In this guide, we’ll break down why a 397 BTC purchase matters, how recurring accumulation shapes supply and price discovery, and how you can participate—as a retail investor, trader, or treasury professional—without overexposure. You’ll see how the Bitcoin buying spree intersects with market structure, liquidity, regulation, and macro crosswinds, so you can act with clarity instead of reacting to noise.

The Bitcoin buying spree doesn’t stop.

When large allocators keep adding coins through drawdowns and breakouts, they transmit a powerful signal: conviction. A single 397 BTC allocation may not move markets instantly, but it reinforces a drumbeat of accumulation that reduces liquid supply over time. Each headline about a Bitcoin buying spree highlights two realities: institutions increasingly treat BTC as a strategic, long-duration asset, and the tradeable float is smaller than raw supply suggests. As more balance sheets and funds participate, the effect compounds—a quiet but persistent suction of coins from exchanges into cold storage.

The narrative amplifier

Every publicised buy becomes a narrative amplifier. It normalises BTC on corporate balance sheets, sparks board discussions, and nudges risk and accounting teams to design custody, reporting, and audit frameworks. The Bitcoin buying spree is as much operational and cultural progress as it is capital deployment.

What’s driving the Bitcoin buying spree

Multiple drivers sustain the bid for BTC. Understanding them helps you judge whether accumulation is likely to persist.

Corporate treasury diversification

In an environment of inflation uncertainty and currency diversification needs, treasurers look beyond cash and short-term paper. BTC offers a non-sovereign, digitally native asset with asymmetric upside. Allocating a measured slice of treasury reserves to BTC can hedge dilution and align with innovation branding. Hence, the Bitcoin buying spree meshes with long-term corporate objectives rather than contradicts them.

Market structure and liquidity

Spot markets, qualified custodians, and execution venues are more robust than ever. TWAP/VWAP algos, agency OTC desks, and improved post-trade workflows make it operationally straightforward to run a Bitcoin buying spree without telegraphing intent or causing undue slippage. Better rails lower friction, and friction used to be a primary blocker.

Gradual regulatory clarity

No jurisdiction is perfectly settled, but the trajectory is toward clearer guidance on custody, disclosures, accounting, and market integrity. As compliance frameworks mature, the perceived risk of adding BTC decreases. Each incremental bit of clarity enables another incremental allocation, feeding the Bitcoin buying spree over quarters and fiscal years. Signalling and brand strategy

Publicly disclosing a buy signal signals conviction and technological alignment. For some firms, it attracts forward-leaning customers and talent. This reputational upside becomes a secondary engine of the Bitcoin buying spree, making the decision less about speculation and more about positioning.

Supply dynamics: why 397 BTC is more than a headline

BTC’s hard cap and hold behaviour matter. When coins migrate from exchanges to long-term custody, the effective float shrinks.

Float shrinkage vs. total supply

Total supply isn’t the same as available supply. Coins held by long-term holders and corporate treasuries rotate infrequently. A Bitcoin buying spree accelerates this migration into deep storage, thinning sell-side depth on exchanges and making price more sensitive to marginal demand.

Issuance and minbehaviour

Issuance halves roughly every four years. When margins compress or price trends firm, miners may sell fewer coins, allowing more supply to be absorbed by the Bitcoin buying spree without destabilising the price. Reduced new issuance and persistent demand together can tighten the market.

Reflexivity in action

As supply tightens and institutional adoption spreads, rising prices spark more boardroom conversations, which beget more buys. The Bitcoin buying spree is reflexive: price strength invites allocations; allocations can sustain strength.

Strategy’s purchase in context

Strategy’s 397 BTC buy sits within a broader pattern: public companies, funds, family offices, and high-conviction individuals programmatically accumulating BTC. The Bitcoin buying spree is distributed, not centralised—many balance sheets speak the same language: scarcity, durability, and digital portability.

Execution: block vs. programmatic

To avoid slippage and signalling risk, large buyers often split orders across time. TWAP or VWAP schedules, iceberg orders, dark/agency OTC blocks, and internalised liquidity all aim to implement a Bitcoin buying spree discreetly. What looks like sideways price action can conceal persistent accumulation.

Custody, keys, and policies

The operational layer—qualified custody, multi-sig, insurance, SOC audits, segregation of duties—is now enterprise-grade. As these rails improve, committees become more comfortable approving and maintaining allocations. Operational maturity undergirds the Bitcoin buying spree.

How the Bitcoin buying spree can influence the price

Price is set at the margin. When marginal demand outpaces marginal supply, the path of least resistance skews upward.

Microstructure insights

Sustained bids consume resting asks, reveal thin areas in the order book, and can prime the market for impulsive moves when catalysts hit. A steady Bitcoin buying spree doesn’t guarantee parabolic action, but it increases the odds that good news travels further, faster.

The volatility paradox

Institutional accumulation can cushion drawdowns (bids on dips), yet rising prices and crowded narratives can also invite leverage, which raises realised volatility. The Bitcoin buying spree often compresses volatility before releasing it in bursts.

Psychology and regime shifts

As higher lows establish, traders start treating dips as opportunities rather than exits. The cadence of a Bitcoin buying spree helps shift regimes from “sell-the-rip” to “buy-the-dip,” at least until leverage or macro shocks reset positioning.

Portfolio implications: navigating the Bitcoin buying spree

You can benefit from the trend without mimicking a corporate treasury. The key is a disciplined process.

Sizing and risk controls

Treat BTC like a high-volatility asset. Define maximum allocation, set drawdown thresholds, and pre-commit to rebalancing rules. Embracing the Bitcoin buying spree as a thesis doesn’t mean abandoning risk management.

Entry strategies that work

-

Dollar-Cost Averaging (DCA): A mechanical approach mirroring how many institutions accumulate. It aligns perfectly with a Bitcoin buying spree while dampening the urge to time tops and bottoms.

-

Range-bound adds: Use support/resistance bands and momentum filters to scale entries.

-

Event-driven bullets: Reserve a small sleeve for macro prints, ETF flow surprises, or regulatory catalysts.

Time horizons matter

A multi-year horizon fits the Bitcoin buying spree the best. Short-term traders should focus on execution quality and risk tightness; long-term allocators should automate and rebalance on schedule.

Risk lens—what could derail the Bitcoin buying spree

No trend is invincible. It’s important to map headwinds in advance.

Regulatory shocks

Unexpected policy turns, adverse tax/accounting rules, or constraints on market infrastructure can slow committee approvals. The Bitcoin buying spree thrives on clarity; uncertainty delays decisions.

Macro liquidity and rates

When real rates rise or credit conditions tighten, risk assets reprice. Even strong structural demand can be overwhelmed by forced de-risking. Stress tests should assume the Bitcoin buying spree continues, but does not immunise against drawdowns.

Custody or market incidents

A major security failure, blow-up, or exchange disruption can chill sentiment. That’s why decentralising custody, enforcing segregation, and strengthening risk controls are essential to sustaining the Bitcoin buying spree over cycles.

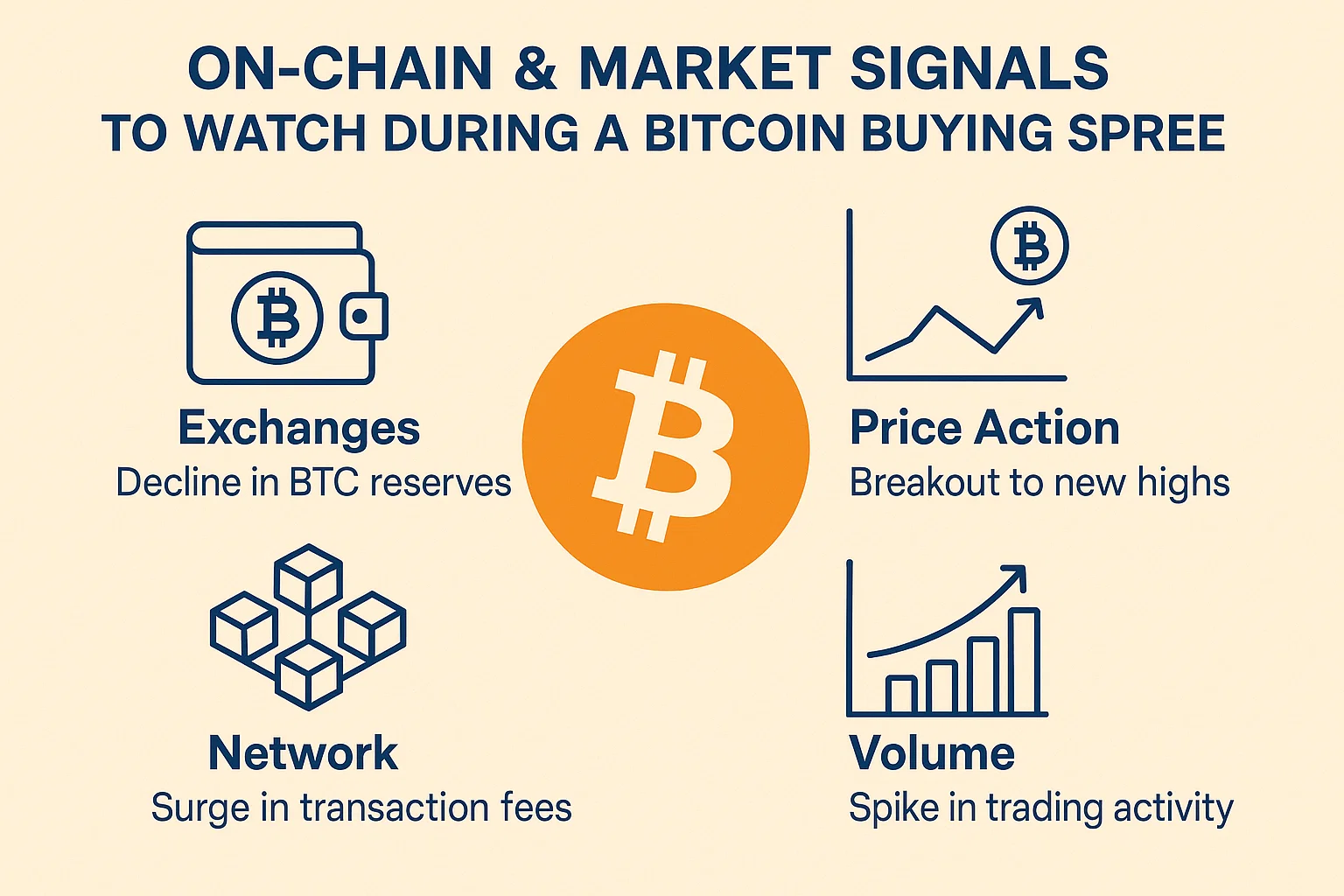

On-chain & market signals to watch during a Bitcoin buying spree

You don’t need a PhD to track useful indicators that corroborate accumulation.

Exchange balances and flows

Declining exchange reserves—especially when price grinds up—often indicate coins moving to custody. It’s a classic tell that a Bitcoin buying spree is absorbing issuance and weak-hand supply.

Realised cap and holder cohorts

Rising long-term holder supply and elevated realised cap per coin show conviction. If coins migrate to older cohorts, it suggests the Bitcoin buying spree ends in cold storage, not in hot speculative rotation.

Funding, basis, and OI

Watch derivatives: overheated funding rates or stretched futures basis can precede shakeouts. During a Bitcoin buying spree, be wary of adding with crowded leverage; keep spot bias or hedge perps.

Macro backdrop supporting the Bitcoin buying spree

Context matters. A few macro themes act as a tailwind.

Digital scarcity in a fiat world

As balance sheets grow and monetary policy cycles stretch, non-sovereign scarce assets appeal to allocators. BTC’s programmatic issuance schedule adds credibility. The Bitcoin buying spree is a rational response to that credibility.

Technology adoption curves

Like other networked technologies, adoption is non-linear. Infrastructure improvements (custody, reporting, liquidity) can unlock new user classes. The Bitcoin buying spree maps to S-curve dynamics: gradual, then sudden.

Portfolio theory and correlation regimes

Historically, BTC’s correlations with other assets drift over time. Periods of diversification potential incentivise small, persistent allocations—fuel for the Bitcoin buying spree even among conservative allocators.

Tactical playbook: traders riding the Bitcoin buying spree

If you trade around a structural uptrend, process matters more than prediction.

Identify location and trend.

Use weekly/daily trend filters to define bias. In environments where the Bitcoin buying spree is visible via exchange balances and on-chain cues, favour buying dips within uptrends.

Execute with intent

Break entries into smaller clips, avoid panic-buying on vertical candles, and consider post-fill management (trailing stops, partial profit rules). Accumulation phases often reward patience.

Avoid common traps

Over-leveraging into strength, ignoring funding/basis extremes, and chasing crowded narratives are frequent errors. The Bitcoin buying spree rewards persistence, not recklessness.

Corporate treasurers: a framework to join the Bitcoin buying spree

A concise checklist for organisations considering a measured allocation:

Governance and policy

-

Draft an investment policy covering mandate, sizing, rebalancing, and risk.

-

Obtain board approval and define reporting cadence.

-

Clarify legal, tax, and accounting treatments in your jurisdiction.

Operations and custody

-

Select qualified custodians with audit trails, insurance, and segregation of duties.

-

Establish key ceremonies (multi-sig policies, HSM usage) and disaster recovery plans.

-

Document workflows for deposits, withdrawals, and signatory thresholds.

Execution and liquidity

-

Choose execution strategy (TWAP/VWAP/OTC blocks).

-

Monitor slippage, market impact, and counterparty exposure.

-

Implement post-trade settlement controls.

Myths & misconceptions about the Bitcoin buying spree

Separating signal from myth helps you stay grounded.

“It’s just hype; prices will crash.”

Volatility is native to BTC, but structural demand can persist across cycles. The Bitcoin buying is not a guarantee of linear up-moves—rather, it elevates the long-term equilibrium if risk controls remain intact.

“Institutions will dump at the first sign of trouble.”

Many treasury and fund mandates are multi-year, policy-bound, and rebalanced on schedules. Panic-dumping is less likely when governance is codified, which is precisely what enables a sustained Bitcoin buying.

“Retail can’t compete with whales.”

Retail doesn’t need scale to win. DCA, sensible sizing, and patience align your behaviour with the Bitcoin buying —without leverage or timing heroics.

Data and tools that complement the Bitcoin buying spree

A small toolkit can go a long way:

On-chain dashboards

Look for exchange reserves, HODL waves, long-term holder supply, and realised price metrics. They help confirm whether the Bitcoin buying is absorbing float.

Market structure trackers

Monitor order book depth, spread, funding, basis, and open interest. Combine with price structure to find asymmetric spots to add or hedge.

Risk journals and automations

Keep a trading or allocation journal. Automate buys, rebalances, and alerts so you act consistently with your Bitcoin buying thesis instead of reacting emotionally.

FAQs

Q: Is 397 BTC enough to move the market immediately?

A: Not typically. But repeated purchases and multi-entity demand change the distribution of outcomes. The cumulative Bitcoin buying matters more than any single block.

Q: Should retail copy corporate playbooks?

A: Borrow the principles—DCA, multi-year horizon, operational hygiene—without copying the size. That aligns you with the Bitcoin buying while protecting downside.

Q: What if the price dips right after a big buy?

A: That’s normal in volatile assets. Many allocators average over time. A resilient Bitcoin buying often buys weakness to maintain target weights.

Q: Isn’t regulation a wildcard?

A: Yes. That’s why diversification, sizing discipline, and scenario planning are essential—even if the Bitcoin buying continues.

Read more: What I Learned Buying $5 of Bitcoin Daily for a Year