Why is crypto down today? On December 1, 2025, the digital asset market lost over $200 billion in total market capitalisation, with Bitcoin dropping below $87,000 and major altcoins experiencing even steeper declines. This sudden market crash has triggered widespread concern among traders as liquidations exceeded $640 million within 24 hours.

Understanding the reasons behind today’s cryptocurrency market decline requires examining multiple interconnected factors, from technical market dynamics to macroeconomic pressures. This comprehensive analysis explores why crypto is down today and what investors should watch for in the coming days.

What Happened to Crypto Prices Today?

The cryptocurrency market witnessed a sharp correction on December 1, 2025, with the total market capitalisation plummeting by over 5.2% to settle around $3 trillion. Bitcoin dropped 5.3% to $86,153, marking its lowest level in a week and representing a 31.6% decline from its all-time high recorded in October.

Major cryptocurrencies across the board experienced significant losses. Ethereum fell 6% to $2,823, while other prominent assets followed similar downward trajectories. Dogecoin dropped 8.2% to $0.1368, and Solana declined 7.2% to $126. The widespread nature of the selloff indicates systemic market pressure rather than issues with individual cryptocurrencies.

The crypto down today scenario emerged rapidly during overnight trading hours when liquidity typically thins out. Bitcoin lost approximately $4,000 within minutes during thin weekend liquidity conditions, triggering a cascade of automated liquidations that amplified the downward pressure.

Massive Liquidations Trigger Market Cascade

One of the primary reasons why crypto is down today centres on extraordinary liquidation events in the derivatives market. Over $640 million was liquidated across crypto futures markets, with long liquidations accounting for $564 million. The majority of these liquidations occurred within a 12-hour window, highlighting the severity of the market crash.

Liquidations happen when leveraged positions are forcibly closed because traders can’t meet margin requirements. When Bitcoin’s price started dropping during low-liquidity weekend hours, it triggered stop-loss orders and margin calls. This created a domino effect where each liquidation added more selling pressure, pushing prices lower and triggering additional liquidations.

High funding rates, crowded long positions, and thin weekend order books triggered a chain reaction that pulled down Bitcoin, Ethereum, Solana, and XRP simultaneously. Market analysts suggest that just a few hundred million dollars in aggressive selling mathematically erased over $100 billion in market capitalisation during this cascade.

The leverage problem had been building for weeks. According to market data, leverage across futures markets was sitting at record highs immediately before the crash. When traders use excessive leverage, it creates market fragility where even small price movements can trigger devastating liquidation cascades.

Thin Weekend Liquidity Amplified Price Swings

Why is crypto down today becomes clearer when examining market liquidity conditions. Liquidity in crypto markets tends to thin out during late Friday and early Monday hours, with fewer market makers active during weekend hours. During these periods, even relatively small sell orders can lead to disproportionately sharp price swings.

This weekend’s crash occurred during particularly thin liquidity conditions. With institutional traders largely absent and retail trading volumes reduced, the order books couldn’t absorb the selling pressure. Market makers who normally provide liquidity by placing buy and sell orders had reduced their positions, leaving the market vulnerable to sudden moves.

The combination of thin liquidity and high leverage created a perfect storm. More than $700 million in positions were liquidated, despite no major news, macro events, political issues, or FUD driving the move. Traders characterised this as a classic leverage reset, where large holders potentially dumped positions to flush out overextended traders.

Federal Reserve Uncertainty Weighs on Risk Assets

Macroeconomic concerns represent another crucial factor explaining why crypto is down today. Investors are closely monitoring the Federal Reserve’s upcoming policy meeting scheduled for December 10, 2025, with uncertainty surrounding potential interest rate decisions creating volatility across risk assets.

The probability of a Federal Reserve rate cut now stands at 22%, down from a likelihood of 97% as of mid-October, according to economists surveyed. This dramatic shift in expectations has created uncertainty in financial markets, with crypto assets particularly sensitive to monetary policy changes.

Fed Chair Jerome Powell threw doubt on whether another reduction is coming in December, stating there were strongly differing views on how to proceed. This commentary during the October meeting caused market participants to recalibrate their expectations, reducing appetite for risk assets like cryptocurrencies.

The Federal Reserve’s stance matters significantly for cryptocurrency markets because crypto down today trends often correlate with broader risk asset sentiment. When the central bank maintains higher interest rates, it makes yield-bearing traditional investments more attractive compared to non-yielding crypto assets.

Global Market Dynamics Impact Crypto

Beyond domestic monetary policy, international financial developments are contributing to why crypto is down today. Japanese bond yields are spiking, with the 2-year hitting its highest level since 2008, and the Yen is surging. These movements in Japanese markets have global implications for cryptocurrency trading.

The strengthening yen and rising Japanese bond yields affect the global carry trade, a strategy where investors borrow in low-interest-rate currencies like the yen to invest in higher-yielding assets. Short-term Japanese yields reached their highest level since 2008, strengthening the yen and pressuring leveraged crypto positions during Hong Kong trading hours.

Traders now see a substantial probability of a Bank of Japan rate hike on December 19. If the BOJ raises rates, it could trigger further unwinding of carry trades, potentially adding more downward pressure on cryptocurrency markets. With markets pricing in possible BOJ hikes, Japanese investors may pull funds back home, tightening global liquidity.

Bitcoin ETF Outflows Add Selling Pressure

The crypto down today situation has been exacerbated by persistent outflows from spot Bitcoin exchange-traded funds. These institutional investment vehicles had been major drivers of Bitcoin’s rally to all-time highs in October, but recent weeks have seen a reversal in flows.

Spot Bitcoin ETF outflows rose to $3.45 billion in November after adding $6.9 billion in the previous two months. This dramatic shift indicates that institutional investors are reducing their cryptocurrency exposure, either to lock in profits or due to concerns about market conditions.

Ethereum ETFs experienced similar trends. Spot Ethereum ETFs shed over $1.42 billion in inflows, bucking a 7-month trend of inflows. When institutional money flows out of these investment products, it creates direct selling pressure on underlying cryptocurrency prices.

The ETF outflows suggest that sophisticated investors are taking a more cautious stance on cryptocurrencies. These institutional participants often have access to more comprehensive market analysis and may be positioning defensively ahead of perceived risks.

Market Sentiment Plunges to Extreme Fear

The emotional state of the market provides additional context for why crypto is down today. The Crypto Fear & Greed Index dropped four points to 24, moving back into “Extreme Fear”. This widely-followed sentiment indicator measures market emotions and trends, with readings below 25 signalling extreme fear among traders.

When market sentiment reaches extreme fear levels, it can become self-reinforcing. Fearful investors may sell positions to avoid further losses, which pushes prices lower and creates even more fear. This psychological cycle can amplify technical factors like liquidations and thin liquidity.

The Crypto Fear and Greed Index moved to the fear zone of 8, its lowest level this year, earlier in November. While today’s reading of 24 shows some recovery from that extreme, it still indicates significant anxiety among market participants.

Interestingly, contrarian investors often view extreme fear as a potential buying opportunity. The theory holds that when everyone is fearful and selling, prices may be oversold, presenting value for those willing to buy when others are panicking.

MicroStrategy’s Bitcoin Strategy Raises Concerns

An unexpected development adding to why crypto is down today involves MicroStrategy, the largest corporate holder of Bitcoin. MicroStrategy has finally acknowledged that a BTC sale could happen under specific crisis conditions, marking the first real shift from CEO Michael Saylor’s longstanding “never sell” philosophy.

CEO Phong Le revealed specific triggers that could force Bitcoin sales. The first trigger is MicroStrategy’s stock falling below 1x mNAV, meaning the market values the company at less than the Bitcoin it owns. The second trigger involves the inability to raise capital through equity or debt markets.

MicroStrategy’s mNAV premium, a key strength for the company, has nearly vanished, sitting around 0.95 as of November 30, just above the 0.9 danger zone. If this metric deteriorates further, the company may need to use its Bitcoin holdings to meet obligations like its $750-800 million annual preferred dividend payments.

The prospect of MicroStrategy potentially selling even a portion of its substantial Bitcoin holdings has created concern among traders. A sale from such a large holder could add significant selling pressure and shake confidence in Bitcoin’s long-term institutional adoption narrative.

Technical Support Levels in Focus

From a technical analysis perspective, crypto down today has pushed Bitcoin to critical support zones that traders are monitoring closely. Bitcoin is currently holding near the key $87,000 support level. Whether this level holds or breaks will likely determine the market’s near-term direction.

If BTC breaks below it, analysts warn it could slide first to $80,400 and potentially toward $75,000 if fear intensifies. These levels represent important technical zones where previous buying activity occurred. Breaking below them could trigger additional selling as traders who bought at those levels face losses.

Conversely, if Bitcoin can hold current support levels and stabilise, it could set the stage for a recovery. Traders note that downside liquidity was cleared first, setting the stage for a potential base formation. This view suggests the market may be undergoing a healthy correction that clears out excess leverage before resuming its uptrend.

Some analysts point to positive technical factors. The price briefly dipped to its long-term trendline but bounced back above it, showing strong demand at a critical level. This trendline has historically sparked significant rallies, and holding above it could signal the higher-timeframe uptrend remains intact.

What’s Next for Cryptocurrency Markets?

Why crypto is down today helps investors prepare for potential near-term developments. Multiple factors will determine whether the market stabilises or faces additional downside pressure in the coming days and weeks.

The Federal Reserve’s December 10 meeting stands as the most significant immediate catalyst. A softer policy outlook could ease pressure on risk assets and help Bitcoin move toward the $100,000 to $105,000 region. However, a more hawkish stance could push markets toward the lower end of recent ranges.

Market participants should monitor several key indicators:

Derivatives market positioning: Watch funding rates and open interest to gauge whether leverage is building back up or staying reduced. Lower leverage makes the market less vulnerable to liquidation cascades.

Liquidity conditions: Order book depth and trading volumes provide insight into market stability. Improving liquidity can help absorb selling pressure more effectively.

ETF flows: Changes in Bitcoin and Ethereum ETF flows signal institutional investor sentiment. Sustained inflows could provide buying pressure, while continued outflows suggest ongoing distribution.

Macroeconomic data: Employment reports, inflation figures, and central bank communications influence risk asset appetite. Positive economic data supporting rate cuts would likely benefit cryptocurrencies.

Technical levels: Key support and resistance zones on charts help identify potential turning points. Breaking below major support could trigger additional selling, while reclaiming resistance levels might signal trend reversal.

Alternative Perspectives on Market Correction

While today’s decline raises concerns, some industry voices maintain a more constructive long-term outlook even as crypto is down today. Dragonfly managing partner Haseeb pointed to a wave of doubt that has spread across communities, where even established assets like ETH and SOL are being written off.

He compared the current scepticism to early doubts about Amazon, suggesting that investors often struggle to judge long-term compounding when evaluating emerging technologies. With Ethereum only a decade old, current market discomfort may represent a natural cycle rather than a fundamental failure.

Dom Harz, co-founder of BOB, remains optimistic that 2025 won’t be remembered for price fluctuations but by the steady march of regulatory progress, institutional engagement, and technological developments. This perspective emphasises that price action doesn’t necessarily reflect underlying industry advancement.

Historical patterns also provide context. Altcoins historically outperform Bitcoin when quantitative tightening is not active, with 42-month and 29-month uptrends seen during 2014-2017 and 2019-2022. The Federal Reserve recently ended its 30-month liquidity drain, halting Quantitative Tightening after removing over $2 trillion from the system, which could support longer-term cryptocurrency price appreciation.

Risk Management During Market Volatility

For investors navigating periods when crypto is down, today becomes the headline, and proper risk management becomes essential. Today’s market action demonstrates how quickly conditions can change and how leverage can amplify losses.

Several risk management principles deserve emphasis:

Position sizing: Never allocate more capital to cryptocurrency than you can afford to lose. Even Bitcoin, the largest and most established cryptocurrency, can experience 30%+ drawdowns.

Leverage awareness: Today’s liquidation cascade shows the danger of excessive leverage. Trading with borrowed money magnifies both gains and losses, and market volatility can wipe out leveraged positions in minutes.

Diversification: Holding multiple assets across different classes can reduce portfolio volatility. When crypto crashes, having exposure to other asset types provides balance.

Emotional discipline: Extreme fear and greed drive poor investment decisions. Having predetermined entry and exit strategies helps avoid emotional trading during volatile periods.

Long-term perspective: Short-term price movements, even dramatic ones, matter less for investors with multi-year time horizons. Focus on fundamental adoption trends rather than daily price action.

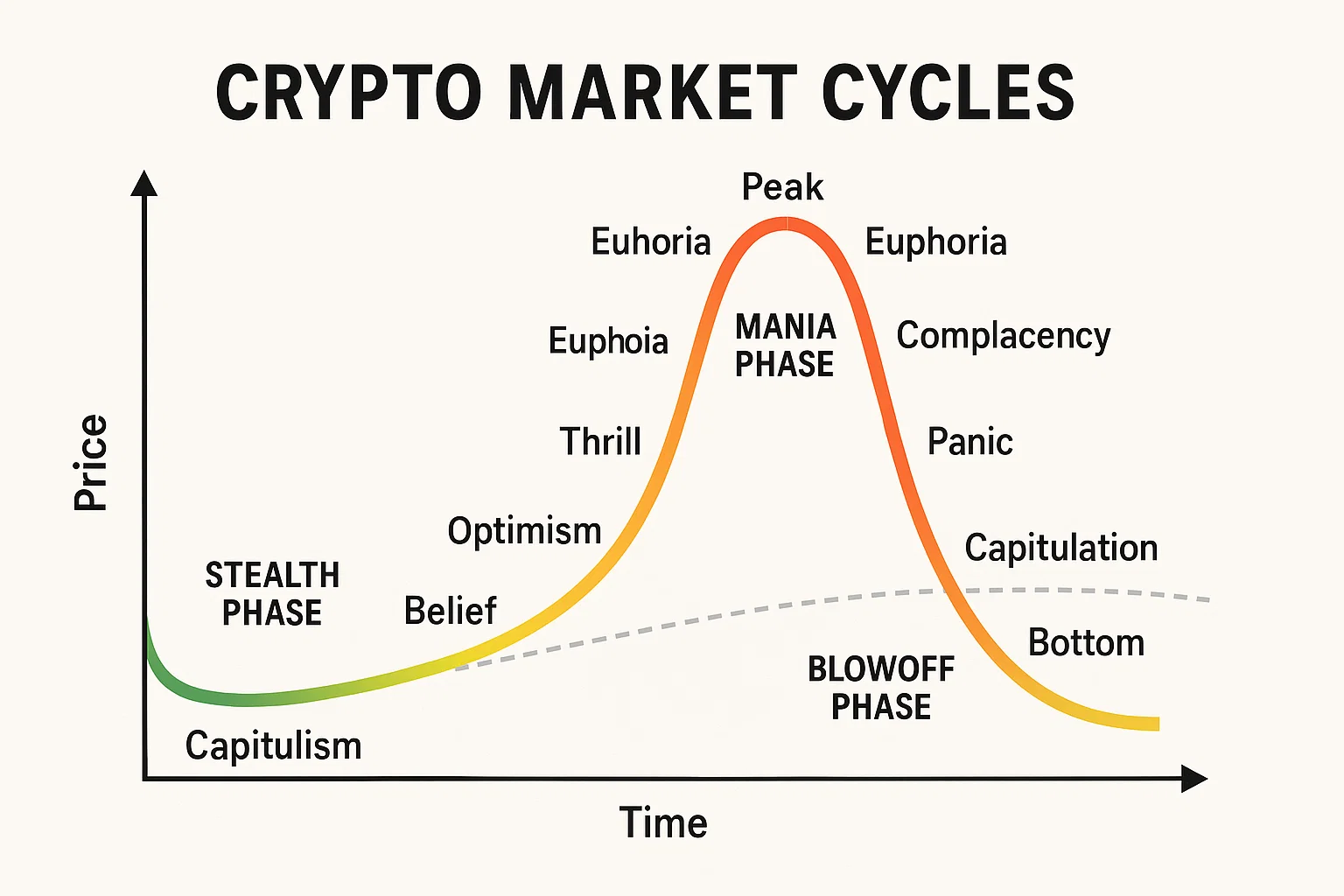

Crypto Market Cycles

Today’s decline fits within larger cryptocurrency market cycle patterns. Digital assets have historically experienced significant volatility, with sharp corrections being normal even within long-term bull markets.

Previous cycles show that drawdowns of 30% or more from recent highs occur regularly in cryptocurrency markets. Bitcoin has experienced multiple corrections exceeding 50% during its history, yet it has also delivered exceptional long-term returns for patient holders.

The current correction may represent a healthy reset of market conditions. Traders say the sharp drop looks like a classic leverage reset, with whales dumping price to flush out overextended positions. These resets can clear out weak hands and excessive speculation, creating a more sustainable foundation for future growth.

Seasonal patterns may also play a role. December historically shows mixed performance for cryptocurrencies, with some years delivering strong gains while others see consolidation or declines. The upcoming Federal Reserve meeting and year-end positioning by institutional investors add to typical seasonal dynamics.

Conclusion

Why crypto is down today requires examining the convergence of multiple factors, from technical market dynamics to macroeconomic pressures. The December 1, 2025, market crash resulted from thin weekend liquidity, excessive leverage triggering massive liquidations, Federal Reserve policy uncertainty, and global market developments affecting risk asset appetite.

While today’s decline is significant, it occurs within the context of normal cryptocurrency market volatility. Digital assets remain inherently volatile, with sharp corrections being regular features of the market. The current crypto down today situation may create opportunities for long-term investors willing to tolerate short-term volatility.

Read more: Bitcoin and Ether Hit New Lows as Crypto Market Crashes