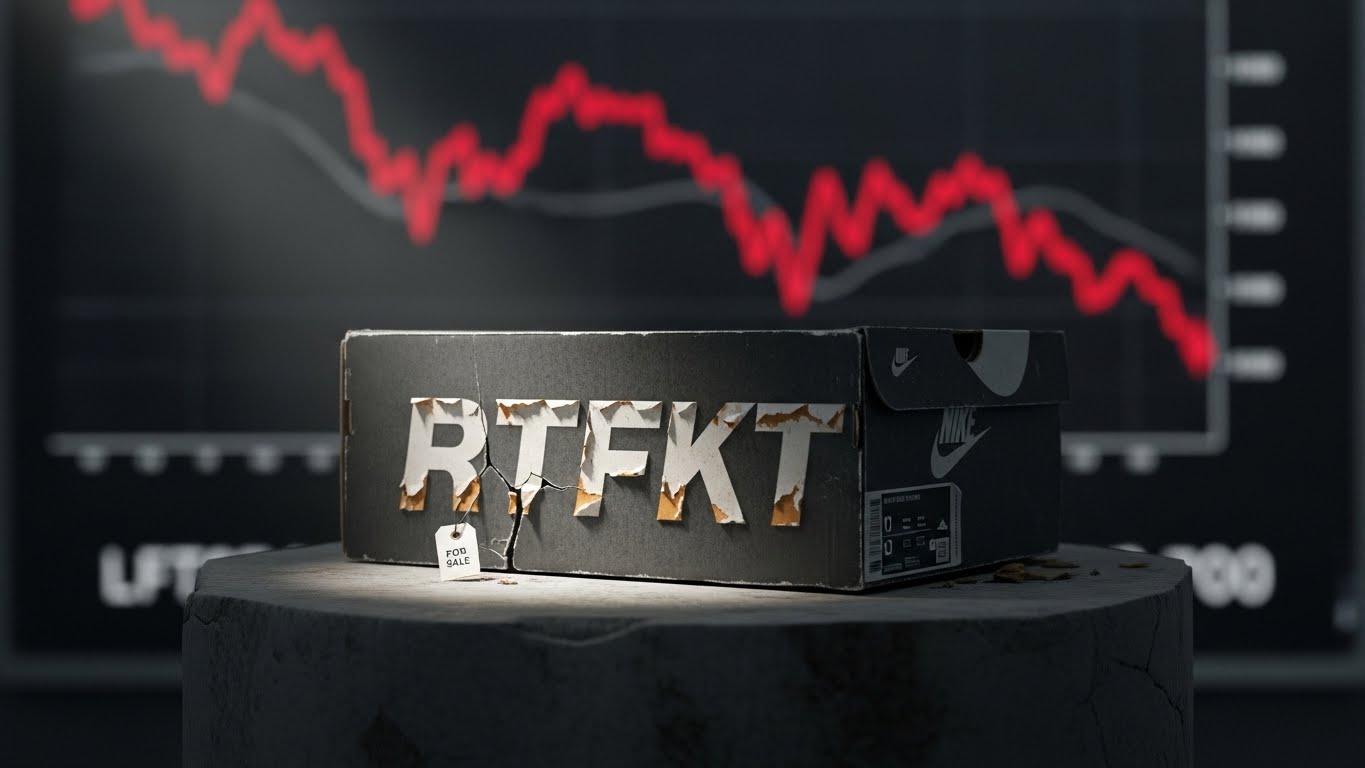

Nike’s entry into Web3 once symbolized how far non-fungible tokens and digital fashion had penetrated mainstream culture. When the global sportswear giant acquired RTFKT, a cutting-edge digital collectibles studio, it sent a powerful message that NFTs were not just a passing trend but a new frontier for brand engagement, virtual identity, and digital ownership. The move was celebrated across the NFT market, viewed as a validation of blockchain-based creativity by one of the world’s most influential consumer brands.

Yet, as market conditions changed and enthusiasm around NFTs cooled, the narrative began to shift. In a move that surprised many observers, Nike quietly sold its digital subsidiary RTFKT, signaling a strategic recalibration rather than a dramatic exit. The decision came without major announcements or marketing fanfare, reinforcing the idea that the company was making a deliberate and measured adjustment to its digital strategy.

This development raises important questions about the future of NFTs, corporate involvement in Web3, and how major brands adapt when emerging technologies mature faster than expected. This article explores why Nike acquired RTFKT in the first place, what led to the sale, how the cooling NFT market influenced the decision, and what this shift means for the broader digital collectibles ecosystem.

The Rise of RTFKT and Its Appeal to Nike

RTFKT’s Origins and Digital-First Vision

RTFKT emerged as a pioneer in the NFT space by blending streetwear culture, gaming aesthetics, and blockchain technology. Known for its futuristic sneakers and avatar-compatible digital wearables, the studio attracted a loyal community of collectors and creators. Its products were not just static images but interactive assets designed for virtual environments and metaverse platforms.

This digital-native approach resonated with younger audiences who valued self-expression in online spaces. RTFKT positioned itself at the intersection of fashion, technology, and culture, making it an attractive acquisition target for a brand like Nike that has long thrived on innovation and storytelling.

Why Nike Entered the NFT Space

Nike’s acquisition of RTFKT reflected its broader ambition to lead in digital transformation. The brand saw NFTs as a way to extend its influence beyond physical products into virtual fashion, gaming, and immersive experiences. By integrating RTFKT’s expertise, Nike aimed to explore new revenue streams and deepen customer engagement through digital ownership.

At the time, the NFT market was booming, with record-breaking sales and widespread media attention. For Nike, acquiring RTFKT was not just about NFTs but about positioning itself for a future where digital and physical identities increasingly overlap.

The NFT Market Boom and Subsequent Cooling

Peak Hype and Market Expansion

The NFT market experienced explosive growth during its peak years, driven by speculative interest, celebrity endorsements, and rapid platform development. Digital art, collectibles, and virtual land became household topics, attracting both retail and institutional participants. Brands across industries rushed to launch NFT projects, hoping to capture value and relevance in this new digital economy. Nike’s move was part of a broader trend that saw traditional companies embrace blockchain innovation as a competitive advantage.

Signs of Market Saturation

As the market matured, signs of saturation began to appear. Prices declined, trading volumes fell, and many projects struggled to maintain community engagement. Speculation gave way to skepticism, and the narrative shifted from rapid growth to long-term sustainability. This cooling phase forced companies to reassess their strategies. NFTs were no longer guaranteed sources of hype or revenue, requiring deeper integration and clearer value propositions to justify continued investment.

Why Nike Quietly Sold RTFKT

Strategic Reassessment Rather Than Retreat

Nike’s decision to sell RTFKT does not necessarily signal a rejection of NFTs. Instead, it reflects a strategic reassessment of how digital initiatives align with core business objectives. Managing a standalone digital subsidiary requires resources, focus, and long-term commitment, particularly in a market undergoing correction. By quietly selling RTFKT, Nike avoided drawing unnecessary attention or fueling negative speculation. The move suggests a preference for flexibility and adaptability rather than a complete withdrawal from Web3 innovation.

Financial Discipline and Market Realities

As market conditions tightened, companies across sectors prioritized efficiency and profitability. The cooling NFT market reduced the immediate upside of maintaining a dedicated digital collectibles studio. Selling RTFKT allowed Nike to streamline operations while potentially retaining the option to collaborate externally on future digital projects. This approach aligns with a broader trend among corporations that are shifting from experimental expansion to disciplined consolidation in emerging technology spaces.

Impact on RTFKT and Its Community

Independence and Creative Freedom

For RTFKT, the sale may represent an opportunity to regain independence and creative autonomy. Operating outside a corporate structure can allow greater flexibility in experimentation and community-driven development. Many creators view decentralization as a core value of the NFT space, making independence a potential strength. The challenge lies in maintaining momentum without the backing of a global brand. RTFKT’s ability to innovate and sustain its audience will depend on how effectively it adapts to a more competitive and cautious market environment.

Community Trust and Long-Term Value

Community trust is critical in the NFT ecosystem. Transparent communication and consistent delivery help maintain confidence during periods of change. While Nike’s quiet exit raised questions, it also avoided the disruption that might have accompanied a more public divestment. How RTFKT engages its collectors and expands its vision post-sale will shape perceptions of its long-term value within the digital asset space.

What This Means for Corporate NFT Strategies

Lessons for Brands Entering Web3

Nike’s experience offers valuable lessons for other brands considering or already engaged in NFTs. Initial hype can drive rapid adoption, but sustainable success requires alignment with brand identity, customer value, and long-term strategy. Corporations must evaluate whether to build in-house capabilities, acquire specialized studios, or collaborate with external partners. Each approach carries different risks and rewards, particularly as markets evolve.

From Ownership to Partnership Models

The sale of RTFKT may signal a shift toward partnership-based models rather than outright ownership. Collaborations allow brands to participate in digital innovation without bearing full operational responsibility. This flexible approach can be more resilient during market downturns. As the NFT market cools, brands are likely to prioritize quality, utility, and meaningful engagement over volume and speculation.

Broader Implications for the NFT Market

Maturation and Realignment

The cooling of the NFT market does not equate to its demise. Instead, it reflects a period of maturation where weaker projects fade and stronger concepts endure. Market cycles are common in emerging technologies, and NFTs are no exception. Nike’s move highlights the transition from hype-driven growth to value-driven development. Projects that focus on genuine utility, creativity, and community are more likely to thrive in this environment.

Redefining Success Metrics

Success in the NFT space is increasingly measured by engagement, retention, and real-world integration rather than short-term price appreciation. Brands and creators must rethink how they define and pursue success. This realignment encourages innovation that extends beyond collectibles into experiences, interoperability, and digital identity.

Nike’s Broader Digital Strategy Beyond NFTs

Focus on Core Digital Platforms

Nike continues to invest heavily in digital platforms that support its core business, including e-commerce, membership ecosystems, and data-driven personalization. These initiatives offer measurable returns and align closely with consumer behavior. By reallocating resources, Nike can maintain leadership in digital transformation without overexposure to volatile markets.

NFTs as One Tool Among Many

NFTs remain part of Nike’s digital toolkit, but not the sole focus. The brand can integrate blockchain elements selectively, leveraging lessons learned from RTFKT without committing to full ownership structures. This balanced approach reflects a nuanced understanding of digital innovation as an evolving process rather than a single bet.

Investor and Market Reactions

Interpreting the Quiet Sale

The subdued nature of the sale limited immediate market reaction, but analysts view it as indicative of cautious optimism rather than retreat. Nike demonstrated its willingness to adapt, a trait valued by investors navigating uncertain economic conditions. The move reinforces the idea that successful companies continuously refine their strategies in response to market feedback.

Long-Term Brand Perception

Nike’s brand equity remains strong, supported by decades of innovation and cultural relevance. Its involvement in NFTs, even if scaled back, positioned it as a forward-thinking brand willing to experiment. By exiting quietly, Nike preserved its reputation while avoiding association with market volatility.

The Future of NFTs After the Hype

Sustainable Use Cases Emerging

As speculative interest wanes, sustainable use cases for NFTs are gaining attention. These include ticketing, gaming assets, loyalty programs, and digital credentials. Such applications emphasize functionality over speculation. Nike’s experience underscores the importance of focusing on practical value rather than chasing trends.

Evolution of Digital Ownership

Digital ownership remains a compelling concept, particularly as virtual environments and online identities become more prominent. NFTs may evolve into infrastructure components rather than standalone products. This evolution suggests that while the market cools, the underlying technology continues to develop.

Conclusion

Nike’s quiet sale of RTFKT marks a significant moment in the evolution of corporate involvement in the NFT space. Rather than signaling failure, the move reflects strategic adaptability in response to a cooling market and shifting priorities. Nike entered the NFT arena at a moment of peak enthusiasm, learned valuable lessons, and adjusted its approach as conditions changed.

For the broader NFT market, this development highlights a transition from hype-driven expansion to thoughtful consolidation. Brands, creators, and investors are recalibrating expectations, focusing on sustainable value and meaningful engagement. As the market matures, those who adapt thoughtfully are more likely to succeed.

Nike’s story with RTFKT serves as a case study in how major brands navigate emerging technologies. It demonstrates that innovation requires not only bold entry but also the wisdom to evolve, pause, or pivot when necessary. The future of NFTs may be quieter than the boom years, but it remains full of potential for those willing to build with purpose.

FAQs

Q: Why did Nike sell its digital subsidiary RTFKT?

Nike sold RTFKT as part of a strategic reassessment following the cooling of the NFT market. The decision reflects a shift toward financial discipline and alignment with core business priorities rather than a complete exit from digital innovation or blockchain-based initiatives.

Q: Does Nike’s sale of RTFKT mean it is abandoning NFTs?

No, the sale does not indicate that Nike is abandoning NFTs entirely. Instead, it suggests a move away from owning a standalone NFT studio toward more flexible approaches, such as selective collaborations or integration of digital assets within existing platforms.

Q: How does the cooling NFT market affect digital fashion and collectibles?

The cooling NFT market signals a transition from speculative hype to sustainable development. Digital fashion and collectibles are likely to focus more on utility, community engagement, and real-world integration rather than short-term price appreciation.

Q: What challenges does RTFKT face after being sold by Nike?

After the sale, RTFKT must maintain momentum without the backing of a global brand. Challenges include sustaining community trust, innovating in a competitive market, and adapting to reduced speculative interest while emphasizing long-term value creation.

Q: What lessons can other brands learn from Nike’s experience with RTFKT?

Other brands can learn the importance of aligning NFT initiatives with long-term strategy, avoiding overreliance on hype, and remaining adaptable. Nike’s experience shows that experimentation is valuable, but flexibility and reassessment are essential as markets evolve.