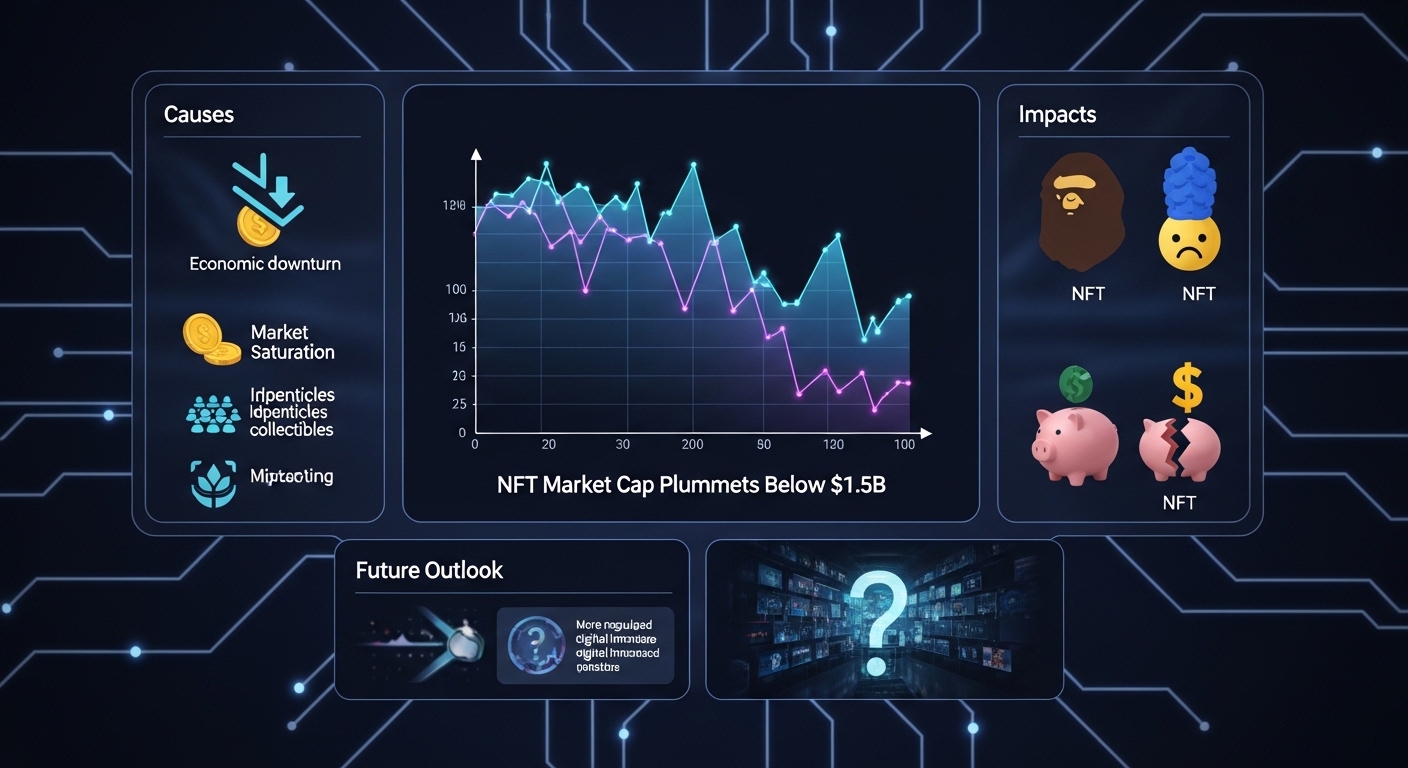

The NFT Market Cap has plunged below $1.5 billion, marking one of the most dramatic downturns in the history of digital assets. Just a few years ago, non-fungible tokens were dominating headlines, generating billions in trading volume, and attracting celebrities, brands, and retail investors alike. Today, however, the sharp contraction in NFT Market Cap is signaling a profound shift in investor sentiment and market dynamics.

This development is more than just a number on a chart. It reflects changing attitudes toward digital collectibles, blockchain technology, and speculative assets in a tightening global financial environment. The NFT boom of 2021 and early 2022 created unprecedented hype, but the recent collapse in NFT Market Cap suggests the market is undergoing a long-overdue correction.

In this article, we explore why the NFT Market Cap has fallen below $1.5B, what it means for creators and investors, and whether the broader crypto market can revive interest in NFTs in the years ahead.

Understanding the NFT Market Cap Decline

The NFT Market Cap represents the total combined value of all non-fungible tokens currently in circulation. When this metric drops significantly, it indicates reduced demand, declining asset prices, and lower trading activity across major NFT platforms.

The fall of NFT Market Cap below $1.5B is not an isolated event. It follows months of declining trading volumes, fading media attention, and a broader downturn in the cryptocurrency market. As Bitcoin and Ethereum experienced volatility, speculative sectors such as NFTs faced intensified selling pressure.

The decline also reflects a shift from hype-driven investing to more cautious capital allocation. Investors who once chased digital art and profile picture collections are now prioritizing assets with stronger utility or long-term fundamentals.

The End of the NFT Hype Cycle

The explosive growth of NFTs during the bull market created unrealistic expectations. Projects like Bored Ape Yacht Club by Yuga Labs and CryptoPunks originally developed by Larva Labs became cultural phenomena, with some tokens selling for millions of dollars.

However, the hype cycle inevitably cooled. As prices peaked and began to decline, many investors realized that valuations were disconnected from real-world utility. The shrinking NFT Market Cap is now a reflection of that reality check.

Market participants who entered at peak prices have faced heavy losses, which further dampened enthusiasm and liquidity in the ecosystem. Several key factors have contributed to the dramatic drop in NFT Market Cap. Understanding these elements is essential for evaluating whether this downturn is temporary or structural.

Broader Crypto Market Weakness

The NFT ecosystem is deeply interconnected with major cryptocurrencies like Ethereum. When Ethereum’s price declines, the value of NFTs—typically priced in ETH—also falls. Reduced investor confidence in the overall blockchain ecosystem leads to less speculative activity in digital collectibles.

During bearish market cycles, liquidity dries up quickly. As capital flows out of high-risk assets, NFTs often experience sharper corrections than mainstream cryptocurrencies.

Oversupply of Digital Collectibles

One of the major contributors to the falling NFT Market Cap is oversupply. Thousands of new NFT collections flooded the market during the boom phase. Many projects lacked originality, utility, or long-term vision.

This oversaturation diluted demand and created fierce competition among creators. As buyers became more selective, many collections saw floor prices collapse, directly impacting the overall NFT Market Cap.

Reduced Institutional and Celebrity Interest

High-profile endorsements once fueled the NFT surge. Celebrities, athletes, and brands entered the space, driving mainstream attention. However, as prices declined and regulatory scrutiny increased, many public figures stepped back.Without continuous mainstream promotion, retail interest cooled. The decline in NFT Market Cap mirrors this fading spotlight and reduced marketing momentum.

Impact on Digital Creators and Investors

The shrinking NFT Market Cap has profound implications for artists, collectors, and investors who built businesses around digital assets.

Challenges for Artists and Creators

For digital artists, NFTs initially represented a revolutionary income stream. Smart contracts enabled royalty payments, allowing creators to earn on secondary sales. As the NFT Market Cap declined, however, sales volumes fell dramatically.

Many artists now face reduced earnings and increased competition. The market is shifting toward projects with genuine artistic value or real-world integration rather than purely speculative releases.

Investor Sentiment and Risk Reassessment

Investors are reassessing risk exposure in speculative markets. The NFT Market Cap collapse has reinforced lessons about volatility, liquidity risk, and the importance of due diligence.

Collectors who purchased NFTs at inflated prices are now holding assets worth a fraction of their original cost. This experience has made the broader investment community more cautious about emerging digital trends.

Are NFTs Losing Relevance?

Despite the sharp drop in NFT Market Cap, it would be premature to declare the end of NFTs. Instead, the market appears to be transitioning from hype to utility-driven development.

Shift Toward Utility-Based NFTs

The next phase of NFT evolution may focus on practical applications rather than speculative art. Industries such as gaming, ticketing, and intellectual property management are exploring NFT integrations.

For instance, gaming ecosystems like Axie Infinity demonstrated early models of play-to-earn economies, although they too faced sustainability challenges. The future may involve more balanced tokenomics and long-term utility.

Integration with Metaverse Projects

The concept of the metaverse continues to influence NFT innovation. Virtual land and digital identity assets remain part of broader Web3 visions. Platforms like Decentraland and The Sandbox still support NFT-based ownership models.

While the NFT Market Cap has declined, development activity in Web3 infrastructure has not completely stopped. Builders are focusing on scalability, interoperability, and real-world use cases.

Regulatory and Economic Pressures

Global economic uncertainty has also played a role in the NFT Market Cap downturn. Rising interest rates, inflation, and tighter monetary policies have reduced speculative capital.

Regulatory discussions around digital assets have created additional uncertainty. Governments worldwide are evaluating how NFTs fit within existing securities and consumer protection frameworks. Regulatory clarity could eventually restore confidence, but short-term uncertainty contributes to market hesitation.

The Role of Ethereum in NFT Recovery

Ethereum remains the backbone of most NFT projects. Any significant recovery in NFT Market Cap will likely coincide with a resurgence in Ethereum’s ecosystem.

As Ethereum continues to improve scalability and reduce transaction costs, NFT platforms may become more accessible. Lower gas fees and enhanced user experience could attract new participants.

However, the NFT Market Cap recovery depends not only on technology but also on renewed cultural interest and sustainable economic models.

Long-Term Outlook for the NFT Market Cap

The current drop below $1.5B may represent a cleansing phase rather than a permanent collapse. Historically, emerging technologies experience boom-and-bust cycles before achieving maturity.

The NFT Market Cap contraction is eliminating low-quality projects while forcing serious developers to innovate. In the long run, this correction could strengthen the foundation of the digital collectibles industry.

Institutional adoption may return once clearer regulations and more stable market conditions emerge. Additionally, integration with mainstream industries such as entertainment and gaming could reignite growth.

Lessons from the NFT Market Cap Collapse

The fall of NFT Market Cap highlights several key lessons for participants in the digital asset ecosystem. Speculative mania rarely sustains long-term value without underlying utility. Transparency, strong communities, and technological innovation are critical for resilience.

The NFT market is evolving from speculative art trading toward broader digital ownership applications. Investors and creators who adapt to this shift may find opportunities even amid declining valuations.

Conclusion

The NFT Market Cap plummeting below $1.5B marks a sobering moment for the digital collectibles industry. What was once a multi-billion-dollar phenomenon driven by hype and celebrity endorsements has now entered a period of reflection and restructuring.

While the sharp decline signals a stark reality check, it does not necessarily mean the end of NFTs. Instead, it may represent a transition toward a more mature, utility-focused ecosystem. The future of the NFT Market Cap will depend on technological innovation, regulatory clarity, and renewed investor confidence.

As the dust settles, the NFT industry faces a critical question: can it rebuild trust and demonstrate real-world value, or will it remain a cautionary tale of speculative excess?

FAQs

Q: Why did the NFT Market Cap drop below $1.5B so quickly?

The NFT Market Cap fell rapidly due to a combination of broader cryptocurrency market weakness, reduced speculative demand, oversupply of new NFT collections, and declining trading volumes. As Ethereum prices dropped and liquidity tightened, NFT valuations fell sharply. Additionally, investor sentiment shifted away from high-risk digital collectibles, accelerating the downturn.

Q: Does the decline in NFT Market Cap mean NFTs are dead?

The decline in NFT Market Cap does not necessarily mean NFTs are finished. Instead, it signals a market correction after an overheated bull run. Many low-quality projects have disappeared, but developers continue building utility-based NFT applications in gaming, ticketing, and digital identity sectors. The market may be entering a more sustainable phase focused on long-term value.

Q: Can the NFT Market Cap recover in the future?

Recovery is possible if broader crypto market conditions improve and new use cases drive renewed demand. Innovations in blockchain scalability, clearer regulations, and integration into mainstream industries could help restore confidence. However, future growth is likely to be slower and more fundamentals-driven compared to the previous hype cycle.

Q: How does Ethereum affect the NFT Market Cap?

Ethereum plays a central role because most NFTs are minted and traded on its blockchain. When Ethereum experiences price volatility or network congestion, NFT prices and activity often decline as well. Improvements in Ethereum’s infrastructure could positively influence the NFT Market Cap by lowering transaction costs and enhancing user experience.

Q: What lessons should investors learn from the NFT Market Cap collapse?

Investors should recognize the importance of evaluating fundamentals rather than chasing hype. The NFT Market Cap collapse demonstrates how quickly speculative bubbles can burst. Diversification, thorough research, and understanding project utility are essential when participating in emerging digital asset markets.