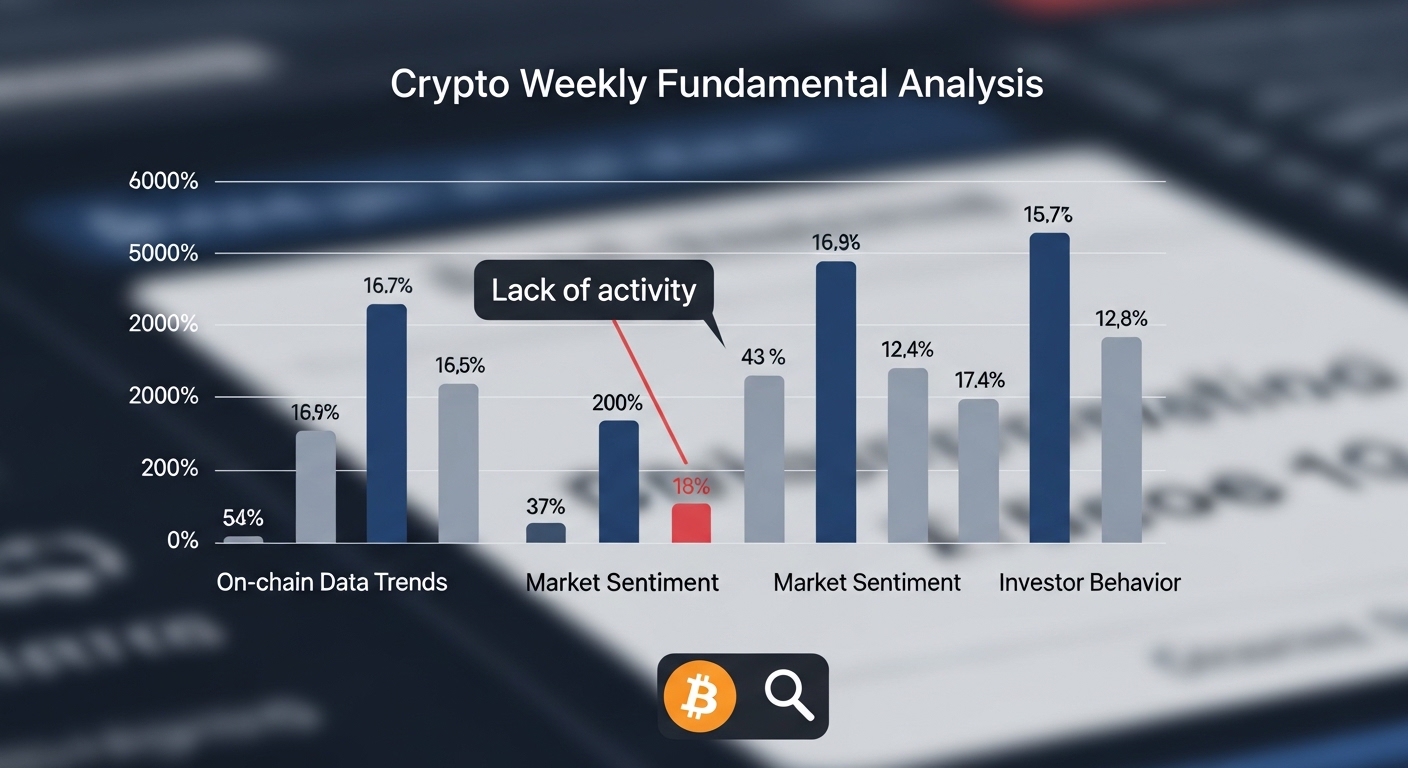

The digital asset market has entered a phase that many analysts describe as unusually quiet. In this edition of Crypto Weekly Fundamental Analysis, the spotlight falls on a striking pattern: lack of activity remains consistent even in Bitcoin. Despite Bitcoin’s position as the leading cryptocurrency by market capitalization, recent on-chain metrics, trading volumes, and network engagement levels suggest a prolonged period of subdued momentum.

For seasoned investors, this stagnation raises important questions. Is the market consolidating before a major breakout, or does this quiet phase signal deeper structural hesitation? A comprehensive Crypto Weekly Fundamental Analysis helps unpack these developments by examining on-chain metrics, trading volume trends, market sentiment indicators, and the broader blockchain ecosystem.

While price movements often dominate headlines, fundamentals provide deeper insight into the health of the network. This article explores why activity remains muted, what it means for Bitcoin and the wider crypto space, and how investors can interpret this data-driven landscape.

Understanding Crypto Weekly Fundamental Analysis

Crypto Weekly Fundamental Analysis is more than a review of price charts. It evaluates the underlying health of blockchain networks by examining metrics such as transaction volume, active addresses, hash rate, liquidity, and institutional participation.

When lack of activity remains consistent even in Bitcoin, analysts turn to these metrics to determine whether the slowdown reflects temporary consolidation or broader investor caution. By analyzing network activity, wallet growth, and capital inflows, it becomes possible to identify early signals of trend reversals or sustained stagnation.

Unlike technical analysis, which focuses on chart patterns, fundamental analysis measures real-world engagement with the blockchain. In Bitcoin’s case, these indicators currently suggest a cooling phase.

Bitcoin’s On-Chain Activity Shows Persistent Weakness

One of the most notable findings in this Crypto Weekly Fundamental Analysis is the steady decline in on-chain engagement. Metrics such as daily transactions and active wallet addresses have remained relatively flat or even decreased in recent weeks.

Bitcoin historically thrives during periods of heightened transaction activity. When network usage slows, it often reflects reduced speculative trading or lower retail participation. This lack of activity remains consistent even in Bitcoin despite occasional short-term price fluctuations.

Declining transaction fees further reinforce this narrative. When fewer users compete to process transactions, average fees drop, indicating lighter network congestion. While lower fees benefit users, they also highlight subdued demand for block space.

The broader implication is clear: despite Bitcoin’s dominance, real usage levels are not accelerating.

Trading Volume and Market Liquidity Trends

Another key area within Crypto Weekly Fundamental Analysis is trading volume. Across major exchanges, Bitcoin’s spot and derivatives volumes have shown signs of contraction compared to peak cycles.

Lower trading volume suggests diminished speculative enthusiasm. When traders step back, liquidity thins, leading to narrower price ranges and slower momentum. This lack of activity remains consistent even in Bitcoin futures markets, where open interest has stabilized rather than expanded aggressively.

Reduced volatility often accompanies such conditions. While stability can attract institutional investors seeking predictability, it may also signal hesitation among retail participants.

In fundamental terms, declining volume indicates a market waiting for a catalyst. Without fresh capital inflows or strong macroeconomic drivers, Bitcoin’s momentum remains subdued.

Institutional Participation Remains Measured

Institutional involvement plays a critical role in shaping long-term market trends. However, this Crypto Weekly Fundamental Analysis reveals that institutional inflows have been steady rather than explosive.

While some asset managers continue accumulating Bitcoin as a hedge against inflation or currency debasement, the pace of adoption appears measured. The lack of aggressive accumulation contributes to the broader narrative that lack of activity remains consistent even in Bitcoin.

Large holders, often referred to as whales, have not significantly increased their positions. Instead, many appear to be maintaining existing allocations, waiting for clearer macroeconomic signals.

This cautious stance underscores a broader environment of uncertainty across global financial markets.

Hash Rate Stability Versus Transaction Slowdown

Interestingly, Bitcoin’s network security remains strong despite reduced transaction activity. The hash rate, which represents total computational power securing the network, has remained resilient.

This divergence between strong hash rate and weaker transaction metrics presents a nuanced picture. Miners continue investing in infrastructure, suggesting long-term confidence in the protocol. Yet user activity does not mirror this optimism.

Such dynamics highlight the complexity of Crypto Weekly Fundamental Analysis. While the underlying infrastructure remains robust, immediate user demand appears restrained.

The sustained hash rate supports network integrity but does not necessarily translate into short-term price appreciation.

Market Sentiment and Investor Psychology

Market sentiment plays a powerful role in shaping crypto cycles. In the current phase, sentiment indicators reveal cautious optimism rather than exuberance.

Social media engagement, search trends, and retail trading app activity have all moderated compared to prior bull runs. This lack of activity remains consistent even in Bitcoin-related discussions, which historically surge during rapid price rallies.

Investor psychology often shifts from fear to euphoria in cycles. Presently, the market seems to occupy a neutral zone, where neither panic selling nor aggressive buying dominates.

From a fundamental perspective, such equilibrium can precede either a breakout or extended consolidation. Analysts therefore monitor subtle shifts in behavior to anticipate the next move.

Macroeconomic Influences on Crypto Activity

No Crypto Weekly Fundamental Analysis would be complete without considering macroeconomic factors. Interest rate policies, inflation data, and global economic conditions heavily influence digital asset demand.

Higher interest rates tend to reduce speculative investments, as capital flows toward lower-risk instruments. In such environments, lack of activity remains consistent even in Bitcoin, as traders adopt defensive strategies.

Currency fluctuations and geopolitical tensions also impact capital allocation decisions. Bitcoin, often marketed as a hedge, sometimes benefits from uncertainty. However, when overall liquidity tightens, even alternative assets experience slower growth.

Understanding these macro drivers provides context for the current stagnation.

The Role of Stablecoins and Capital Flows

Stablecoin supply trends offer additional insight into crypto market fundamentals. When stablecoin issuance expands, it typically signals incoming liquidity ready to deploy into digital assets.

Recent data indicates stablecoin growth has plateaued. This stagnation aligns with the broader theme that lack of activity remains consistent even in Bitcoin.

Without fresh liquidity entering the ecosystem, significant price movements become less likely. Stablecoin reserves on exchanges often act as dry powder for future rallies, and their stagnation suggests limited immediate buying pressure.

Monitoring these flows remains essential for anticipating momentum shifts.

Retail Versus Institutional Dynamics

Retail traders historically drive rapid market surges. During bull markets, new participants enter aggressively, increasing both transaction volume and exchange activity.

Currently, retail participation appears muted. Trading apps report lower user engagement, and search interest for crypto-related terms remains subdued.

Institutional investors, meanwhile, maintain a longer-term outlook. Their gradual accumulation strategies contribute to price stability but do not generate explosive growth.

This balanced yet inactive environment reinforces the central observation of this Crypto Weekly Fundamental Analysis.

Potential Catalysts for Renewed Activity

Although lack of activity remains consistent even in Bitcoin, potential catalysts could quickly alter the landscape. Regulatory clarity, technological upgrades, or macroeconomic shifts may reignite momentum.

Major institutional announcements often trigger renewed interest. Likewise, breakthroughs in blockchain scalability, decentralized finance, or layer-two solutions could increase on-chain engagement.

Bitcoin halving cycles historically influence long-term supply dynamics. Anticipation surrounding such events may eventually stimulate activity.

Fundamental analysis therefore requires continuous monitoring rather than static conclusions.

Comparing Current Conditions to Previous Cycles

Historical comparisons provide valuable context. Previous consolidation phases often preceded substantial bull markets.

In earlier cycles, periods of low volatility and reduced trading volume eventually gave way to renewed enthusiasm. However, each cycle unfolds under unique macroeconomic and technological conditions.

This Crypto Weekly Fundamental Analysis suggests similarities with past accumulation phases. Yet differences in regulatory frameworks and global liquidity may shape outcomes differently.

Understanding historical precedents helps investors avoid emotional reactions during quiet periods.

Long-Term Implications for Bitcoin

Despite subdued activity, Bitcoin’s core value proposition remains intact. The decentralized ledger, fixed supply cap, and robust mining infrastructure continue to attract long-term believers.

Periods of low engagement may serve as opportunities for strategic accumulation. Experienced investors often view stagnation as a time to position ahead of broader market reactivation.

The resilience of network fundamentals, particularly hash rate and security metrics, reinforces confidence in Bitcoin’s longevity. While short-term excitement may wane, foundational strength persists.

Broader Crypto Market Impact

Bitcoin’s inactivity often influences the entire crypto ecosystem. As the market leader, its performance shapes investor sentiment across altcoins and emerging blockchain projects.

When lack of activity remains consistent even in Bitcoin, alternative assets frequently experience similar stagnation. Capital rotation becomes limited, and speculative narratives lose momentum.

However, innovation continues behind the scenes. Development activity within decentralized applications and infrastructure projects remains active despite quieter trading conditions. This contrast between market calm and technological progress defines the current phase.

Conclusion

This Crypto Weekly Fundamental Analysis highlights a clear trend: lack of activity remains consistent even in Bitcoin. From reduced transaction volumes and muted trading activity to measured institutional participation, the market appears to be in a consolidation phase.

Yet beneath the surface, network security remains strong, and long-term fundamentals are intact. While short-term momentum may be limited, the structural integrity of Bitcoin’s blockchain continues to inspire confidence.

Quiet periods are not uncommon in crypto cycles. They often represent transitional stages between larger movements. By focusing on data-driven insights rather than emotional reactions, investors can better navigate these calm waters.

Ultimately, fundamental analysis provides clarity amid uncertainty. Even when activity slows, understanding the underlying metrics ensures informed decision-making.

FAQs

Q: What does it mean when lack of activity remains consistent even in Bitcoin?

When lack of activity remains consistent even in Bitcoin, it means that key metrics such as transaction volume, active addresses, and trading participation show minimal growth or sustained stagnation. This often indicates reduced speculative interest, cautious investor sentiment, and limited new capital inflows. While not necessarily bearish, it suggests the market is in a consolidation phase rather than an expansionary one.

Q: Is low on-chain activity a negative sign for Bitcoin’s future?

Low on-chain activity does not automatically signal long-term weakness. It can reflect temporary consolidation after previous volatility. Many historical bull runs were preceded by quiet accumulation phases. As long as network security metrics like hash rate remain strong, subdued activity may simply indicate patience among investors rather than declining confidence.

Q: How does trading volume influence fundamental analysis?

Trading volume is a crucial component of Crypto Weekly Fundamental Analysis because it reflects liquidity and market engagement. Lower volume often correlates with reduced volatility and limited price momentum. Conversely, rising volume can signal renewed interest and potential breakout conditions. Analysts combine volume data with on-chain metrics to form a comprehensive outlook.

Q: Could macroeconomic factors be responsible for the slowdown?

Yes, macroeconomic conditions such as higher interest rates, inflation concerns, and global economic uncertainty can suppress risk appetite. When liquidity tightens across financial markets, speculative assets like cryptocurrencies often experience reduced activity. Bitcoin’s current stagnation may partially stem from broader economic caution.

Q: What signs should investors watch for renewed activity in Bitcoin?

Investors should monitor increases in transaction volume, active wallet growth, exchange inflows, and stablecoin supply expansion. Rising trading volume and heightened social engagement may also signal renewed interest. A combination of improving on-chain metrics and favorable macroeconomic conditions often precedes sustained upward momentum in the crypto market.