The world of cryptocurrency mining has evolved dramatically, and understanding your potential returns before investing in expensive hardware is crucial. Bitcoin mining profitability calculators have become indispensable tools for both newcomers and seasoned miners looking to optimize their operations. These sophisticated calculators help you determine whether your mining venture will generate profits by analyzing factors like hardware costs, electricity rates, and current Bitcoin prices. In today’s competitive mining landscape, making informed decisions can mean the difference between profitable operations and costly mistakes. Whether you’re considering your first ASIC miner or scaling up an existing operation, these calculators provide the financial insights you need to succeed.

What Are Bitcoin Mining Profitability Calculators?

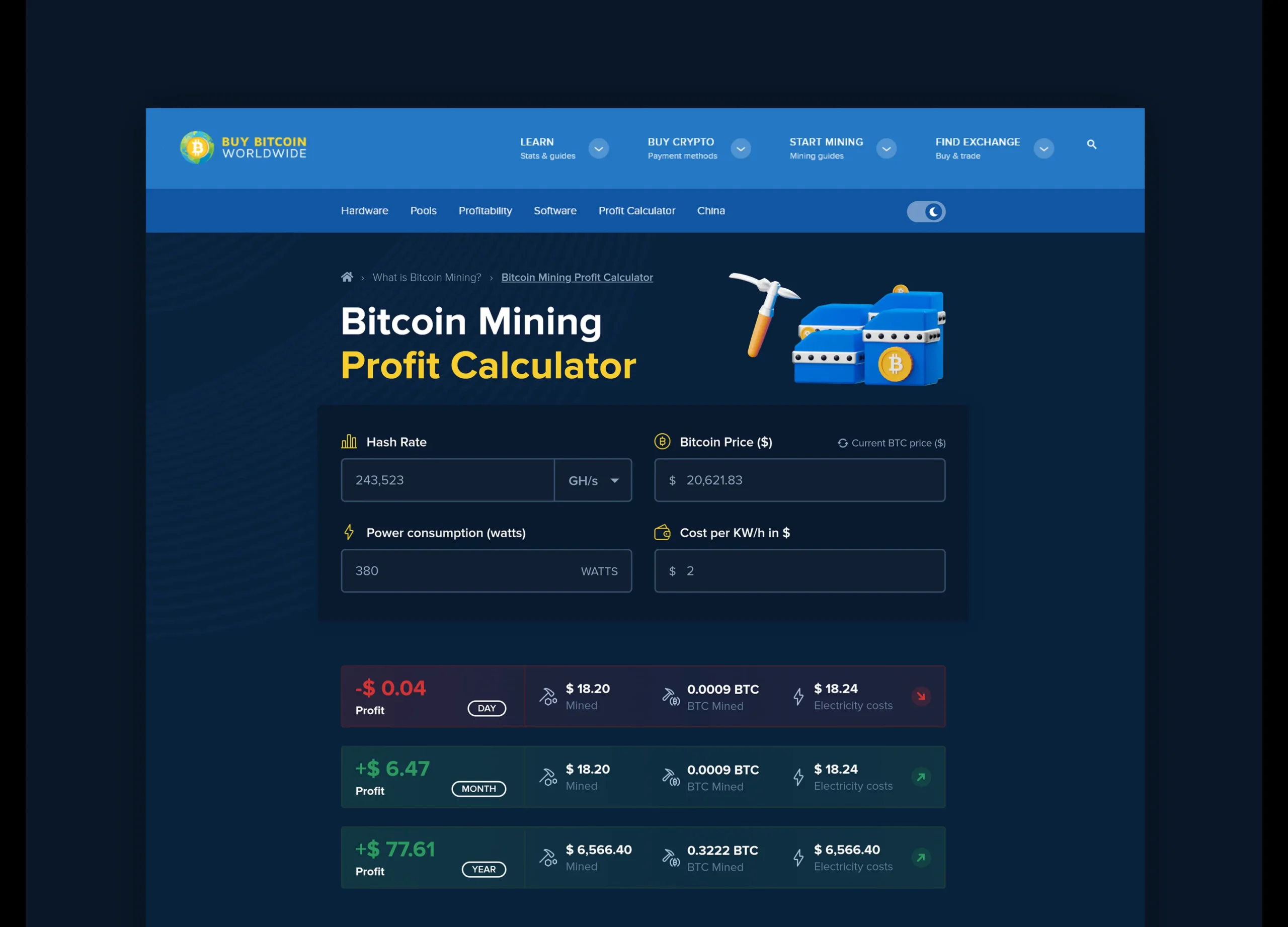

Bitcoin mining profitability calculators are specialized tools that estimate the potential earnings from cryptocurrency mining operations. These calculators analyze multiple variables to provide accurate projections of your mining returns, helping you make data-driven investment decisions. The primary function of these calculators is to determine your daily, monthly, and yearly mining profits by considering your hardware specifications, operational costs, and current market conditions. They serve as financial planning tools that can save you from costly mistakes and help identify the most profitable mining setups.

Key Components of Mining Calculators

Modern Bitcoin mining calculators typically include several essential components:

Hash Rate Input: This represents your mining hardware’s processing power, measured in terahashes per second (TH/s). The hash rate directly impacts your mining rewards, as higher hash rates increase your chances of successfully mining Bitcoin blocks.

Power Consumption: Energy usage is measured in watts and represents one of the most significant ongoing costs in mining operations. Calculators use this data to estimate your electricity expenses accurately.

Electricity Costs: Your local electricity rate, typically measured in cents per kilowatt-hour (kWh), dramatically affects profitability. This variable often determines whether mining operations remain profitable long-term.

Pool Fees: Most miners join mining pools to increase their chances of earning rewards. These pools typically charge fees ranging from 1% to 3% of your earnings.

Hardware Costs: Initial investment in mining equipment affects your return on investment calculations and break-even timelines.

How Bitcoin Mining Profitability Calculators Work

Understanding the mechanics behind these calculators helps you use them more effectively. The calculation process involves several sophisticated algorithms that process real-time market data and your specific mining parameters.

The Calculation Process

Bitcoin mining calculators use complex formulas to estimate your potential earnings. They begin by calculating your expected daily Bitcoin earnings based on your hash rate and the current network difficulty. The network difficulty adjusts approximately every two weeks to maintain consistent block times, directly affecting mining profitability. Your daily revenue calculation typically follows this process: Your hash rate divided by the total network hash rate determines your share of the mining rewards. This percentage is then multiplied by the daily Bitcoin block rewards to estimate your earnings. The calculators then subtract your operational costs, including electricity expenses and pool fees, to determine your net profit. Advanced calculators also factor in hardware depreciation and maintenance costs for more accurate long-term projections.

Real-Time Data Integration

Modern Bitcoin mining profitability calculators pull data from multiple sources to ensure accuracy. They continuously update Bitcoin prices from major exchanges, monitor network difficulty adjustments, and track changes in block rewards. This real-time integration ensures your profitability estimates reflect current market conditions. Network difficulty is particularly important because it directly affects your mining rewards. As more miners join the network, difficulty increases, reducing individual miner earnings. Calculators must account for these fluctuations to provide realistic projections.

Top Bitcoin Mining Profitability Calculators in 2025

Several excellent calculators are available to miners, each offering unique features and advantages. Understanding the strengths of each tool helps you choose the best option for your specific needs.

WhatToMine

WhatToMine stands out as one of the most comprehensive mining calculators available. This platform supports multiple cryptocurrencies and provides detailed profitability comparisons across different coins and algorithms. The interface allows you to input specific hardware models or custom hash rates, making it suitable for both beginners and advanced users. WhatToMine also includes features like electricity cost optimization and hardware comparison tools that help identify the most profitable mining setups .One of WhatToMine’s strongest features is its ability to compare profitability across different cryptocurrencies, helping miners switch to the most profitable coins based on current market conditions.

NiceHash Calculator

NiceHash offers a user-friendly calculator that simplifies the mining profitability analysis process. Their tool is particularly valuable for users of the NiceHash marketplace, where you can rent out your mining power or purchase hash rate for specific cryptocurrencies. The NiceHash calculator provides accurate estimates for their specific ecosystem, including their unique fee structure and payout methods. It’s especially useful for miners who prefer the simplicity of automated profit switching and regular Bitcoin payouts.

CryptoCompare Mining Calculator

CryptoCompare provides a professional-grade mining calculator with advanced features for serious miners. Their tool includes detailed charts showing profitability trends over time and comprehensive market analysis features. The platform’s strength lies in its extensive historical data and trend analysis capabilities. Miners can view profitability projections under different market scenarios and make informed decisions about timing their investments.

ASIC Miner Value Calculator

This specialized calculator focuses specifically on ASIC mining hardware, providing detailed analyses for popular mining rigs. The tool includes specific models from major manufacturers like Bitmain, MicroBT, and Canaan. ASIC Miner Value excels at comparing different hardware options and calculating return on investment timelines. It’s particularly useful when deciding between different mining rig purchases or upgrades.

Essential Features to Look for in Mining Calculators

When selecting Bitcoin mining profitability calculators, certain features can significantly impact the accuracy and usefulness of your analyses. Understanding these features helps you choose tools that provide the most value for your specific mining operations.

Accuracy and Data Sources

The most critical feature of any mining calculator is accuracy. Look for calculators that pull data from multiple reliable sources and update information frequently. The best calculators source Bitcoin prices from major exchanges like Coinbase, Binance, and Kraken to ensure accurate market valuations. Network difficulty data should come directly from the Bitcoin blockchain, and calculators should account for the approximate 14-day difficulty adjustment cycle. Tools that provide historical accuracy data or track their prediction accuracy over time demonstrate commitment to providing reliable estimates.

Hardware Database

Comprehensive hardware databases save time and reduce errors when calculating profitability. The best calculators include specifications for popular ASIC miners, GPUs, and other mining hardware, automatically populating hash rates, power consumption, and typical market prices. Look for calculators that regularly update their hardware databases with new releases and current market prices. Some tools also include user-submitted data and reviews, providing real-world performance insights beyond manufacturer specifications.

Customization Options

Advanced customization options allow you to tailor calculations to your specific situation. Essential customization features include:

Variable Electricity Rates: Some regions have tiered pricing or time-of-use rates that significantly impact profitability calculations.

Custom Pool Fees: Different mining pools charge varying fees, and some calculators allow you to input specific pool fee structures.

Hardware Efficiency Adjustments: Real-world mining hardware performance often differs from manufacturer specifications due to environmental factors and wear over time.

Multiple Scenario Analysis: The ability to run calculations under different market conditions helps with risk assessment and planning.

Factors Affecting Bitcoin Mining Profitability

Understanding the variables that impact mining profitability helps you use calculators more effectively and make better investment decisions. These factors interact in complex ways, making accurate calculation tools essential for successful mining operations.

Bitcoin Price Volatility

Bitcoin’s price volatility significantly impacts mining profitability, often creating dramatic swings in potential earnings. When Bitcoin prices increase, mining becomes more profitable even with higher network difficulty. Conversely, price drops can quickly turn profitable operations into loss-making ventures. Experienced miners use profitability calculators to model different price scenarios and ensure their operations remain viable during market downturns. Some calculators include volatility modeling features that help assess risk under different market conditions.

Network Difficulty Adjustments

Network difficulty represents one of the most important factors affecting mining profitability. As more miners join the network, difficulty increases to maintain consistent 10-minute block times. These adjustments occur approximately every 2,016 blocks (roughly 14 days). Rising difficulty reduces individual miner rewards, while decreasing difficulty (which occurs when miners leave the network) increases rewards. Profitability calculators must account for these cyclical changes to provide accurate long-term projections.

Electricity Costs and Energy Efficiency

Electricity costs often determine whether mining operations remain profitable long-term. Miners in regions with low electricity costs have significant advantages over those paying higher rates. Industrial-scale operations often negotiate special rates with utility companies, further improving their competitive position. Energy efficiency, measured in watts per terahash (W/TH), directly impacts operational costs. More efficient hardware generates higher profits at the same electricity rates, making equipment selection crucial for profitability.

Hardware Costs and Depreciation

Initial hardware investments represent significant upfront costs that affect return on investment calculations. ASIC miner prices fluctuate based on market conditions, with prices typically rising during bull markets and falling during beardowns. Hardware depreciation occurs through both technological advancement and physical wear. Newer, more efficient miners regularly enter the market, reducing the value and competitiveness of older equipment. Calculating depreciation helps determine optimal upgrade timing and equipment lifecycle management.

Common Mistakes When Using Mining Calculators

Even the best Bitcoin mining profitability calculators can produce misleading results if used incorrectly. Understanding common mistakes helps you avoid costly errors and make more accurate profitability assessments.

Overestimating Hardware Performance

Manufacturer specifications often represent ideal conditions that may not match real-world performance. Factors like ambient temperature, altitude, and power supply quality can reduce actual hash rates below advertised levels.

Conservative estimates that account for 5-10% performance degradation from specifications provide more realistic projections. Some experienced miners input slightly lower hash rates to account for these real-world factors.

Ignoring All-In Costs

Many miners focus solely on electricity costs while overlooking other significant expenses. Complete cost analysis should include:

Cooling and Ventilation: Mining hardware generates substantial heat that requires management, especially in warmer climates.

Internet and Infrastructure: Reliable internet connections and proper electrical infrastructure are essential for mining operations.

Maintenance and Repairs: Hardware maintenance, replacement parts, and occasional repairs add to operational costs.

Taxes and Regulatory Compliance: Mining income is typically taxable, and some jurisdictions have specific cryptocurrency regulations.

Static Market Assumptions

Bitcoin markets are highly dynamic, but many miners use calculators with static assumptions about prices and difficulty. Market conditions change rapidly, and profitability calculations should account for this volatility. Regular recalculation using current market data provides more accurate ongoing profitability assessments. Some miners perform weekly or monthly profitability reviews to ensure their operations remain viable.

Advanced Strategies for Mining Profitability

Experienced miners employ sophisticated strategies to maximize profitability beyond basic calculator usage. These approaches can significantly improve returns and reduce risks in mining operations.

Profit Switching and Multi-Algorithm Mining

Profit switching involves automatically mining the most profitable cryptocurrency at any given time. Advanced calculators can help identify optimal switching opportunities by comparing profitability across different coins and algorithms. Some mining software automatically switches between cryptocurrencies based on real-time profitability calculations, maximizing earnings without manual intervention. This strategy requires careful consideration of switching costs and payout structures.

Dollar-Cost Averaging and Timing

Strategic timing of hardware purchases can significantly impact profitability. Dollar-cost averaging involves spreading hardware purchases across time to reduce the impact of price volatility on equipment costs. Mining calculators help identify optimal purchase timing by analyzing historical profitability trends and hardware price cycles. Some miners use these tools to time major equipment upgrades during market downturns when hardware prices are typically lower.

Geographic Arbitrage

Electricity costs vary dramatically between regions, creating opportunities for geographic arbitrage. Miners often use profitability calculators to compare potential earnings across different locations before establishing operations. Countries with abundant renewable energy or government subsidies for electricity often provide the most attractive mining environments. However, regulatory considerations and logistical challenges must be factored into location decisions.

Future of Bitcoin Mining Profitability Tools

The evolution of Bitcoin mining profitability calculators continues as the cryptocurrency ecosystem matures. Understanding emerging trends helps miners prepare for future developments and maintain competitive advantages.

Artificial Intelligence Integration

AI-powered calculators are beginning to incorporate machine learning algorithms that improve prediction accuracy over time. These systems can identify patterns in market data and mining performance that traditional calculators might miss. Advanced AI systems may eventually provide personalized recommendations based on individual mining operations, hardware configurations, and local market conditions. This personalization could significantly improve profitability optimization for miners of all scales.

Real-Time Optimization

Future calculators may integrate directly with mining hardware and software to provide real-time optimization recommendations. These systems could automatically adjust mining parameters based on current profitability calculations and market conditions. Integration with smart contracts and decentralized finance (DeFi) protocols could enable automated profit optimization strategies that execute trades and mining adjustments without human intervention.

Environmental Impact Calculations

Growing environmental awareness is driving development of calculators that include carbon footprint and environmental impact assessments. These tools help miners understand and optimize the environmental implications of their operations. Renewable energy integration features may become standard, helping miners calculate the benefits of solar, wind, and other clean energy sources for their operations.

Conclusion

Bitcoin mining profitability calculators serve as essential tools for anyone serious about cryptocurrency mining success. These sophisticated platforms provide the financial insights necessary to make informed decisions about hardware investments, operational strategies, and long-term planning in the competitive mining landscape. The key to maximizing your mining returns lies in understanding how to effectively use these calculators while accounting for their limitations. Regular recalculation using current market data, conservative assumptions about hardware performance, and comprehensive cost analysis will help ensure your mining operations remain profitable over time.