Bitcoin often takes centre stage in conversations on price swings and market mood, and the cryptocurrency industry is still a volatile place. Bitcoin’s recent decline to $91,000 has generated a lot of discussion among experts and traders. Technical signs imply that the worst may not yet be over, even in light of this significant decline. The emergence of a bearish flag pattern, a well-known chart structure, indicates the possibility of more falls.

Zwin said Bitcoin trades between $95,000 and $90,870, a strong support zone. He also noted that the pioneer cryptocurrency is breaching critical support levels, suggesting a bearish trend. Based on technical indicators and chart patterns, Zwin expects Bitcoin’s price to drop by nearly $91,000. The expert predicted a minimum loss of $91,000 if Bitcoin violates existing support lines.

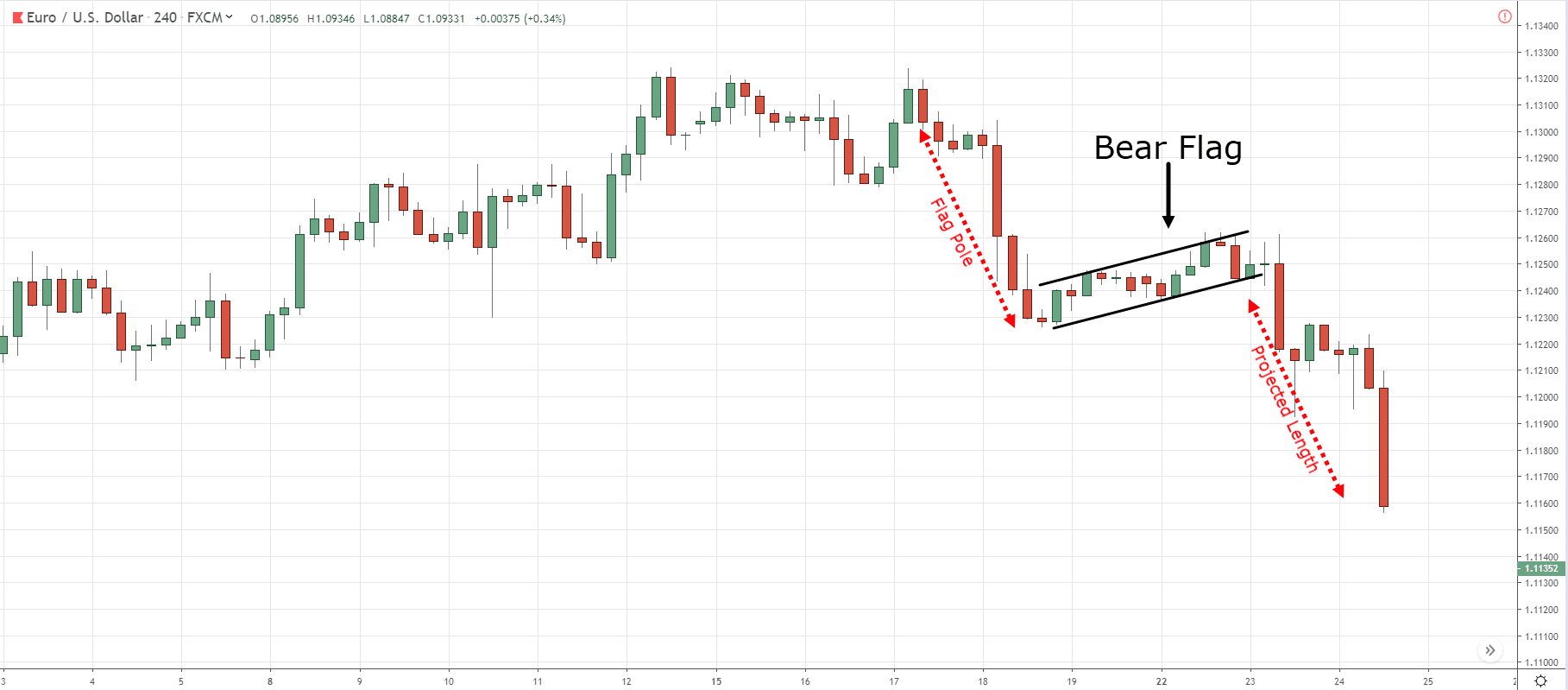

A Bearish Flag Pattern

In technical analysis, the bearish flag pattern is a continuation pattern. It is distinguished by a sharp drop in price, referred to as the “flagpole,” which is followed by a period of consolidation during which prices fluctuate within a small range, creating the “flag.” Usually, this pattern indicates that the price will exit the consolidation zone and resume its downtrend.

In the case of Bitcoin, the flagpole was constructed by the recent $91,000 drop and the sideways trading that followed points to the flag’s construction. According to analysts, if the pattern materializes as anticipated, this configuration may result in yet another major decline.

Signs That Support Bearish Prognosis

Technical and macroeconomic aspects support Bitcoin’s downward trend: Declining activity Trade activity drops during consolidation in the bearish flag pattern’s flag part. Buyers aren’t persuaded price increases are necessary. This element of Bitcoin’s consolidation phase confirms the pattern even more.

Bitcoin’s pessimism is affected by macroeconomic headwinds. Riskier investments like cryptocurrencies are losing investors owing to increasing interest rates, uncertain rules, and shaky global economies. Bitcoin is dangerously close to crucial support levels after its recent drop. Breaking these levels might exacerbate the slide and cause selling pressure.

Fear Predominates in Market Sentiment

There is now a strong fear-based mood in the Bitcoin market. The Crypto Fear & Greed Index, which gauges market mood by looking at variables including volatility, trading volume, and social media trends, makes this clear. Investor caution and hesitancy are indicated by a rating that is much below the “fear” zone, which further reduces the possibility of a short-term positive turnaround.

Prospective Future Situations

Even if the bearish flag pattern points to a continuation of the downward trend, traders should exercise caution and take into account a number of possibilities Breakdown Below Support Levels: Bitcoin may see a sharp drop and test lower psychological levels like $85,000 or even $80,000 if it breaks through its present support zones.

Bitcoin is in a bearish flag pattern, which frequently indicates a continuation of the downturn, according to Zwin. If this flag pattern is maintained, Bitcoin may break downward, causing dramatic price drops. The expert said Bitcoin’s 50-day Moving Average (MA) around $95,974 was a critical barrier or support level. However, the cryptocurrency just fell below this MA, predicting an additional loss.

Fake Breakout and Reversal Bearish flag patterns may sometimes produce fake breakouts, in which prices first decline before experiencing a significant reversal. In these situations, Bitcoin can pick up steam again and surprise short sellers. Sideways Consolidation If Bitcoin stays inside the flag’s range, confusion may linger. Bulls and bears may feel agitated since neither side has a clear edge.

Also Read: Cryptocurrency Key Trends and Predictions for 2025

Conclusion

The bearish flag pattern and Bitcoin’s recent drop to $91,000 highlight cryptocurrency’s continued issues. Even if technical indicators suggest unfavourable outcomes, traders must be alert for alternative conditions. As always, making good decisions in the ever-changing Bitcoin environment entails understanding technical patterns, market sentiment, and macroeconomic difficulties.