Goldilocks Period for Cryptocurrencies Venture capitalist Chris Burniske predicts a “Goldilocks period.” for the bitcoin business. Burniske expects cryptocurrencies to rise steadily under the incoming U.S. administration’s pro-digital asset position. This prediction is vital as the crypto market transforms from a volatile past to a more stable and mature future.

Breaking Bitcoin’s Four-Year Cycle

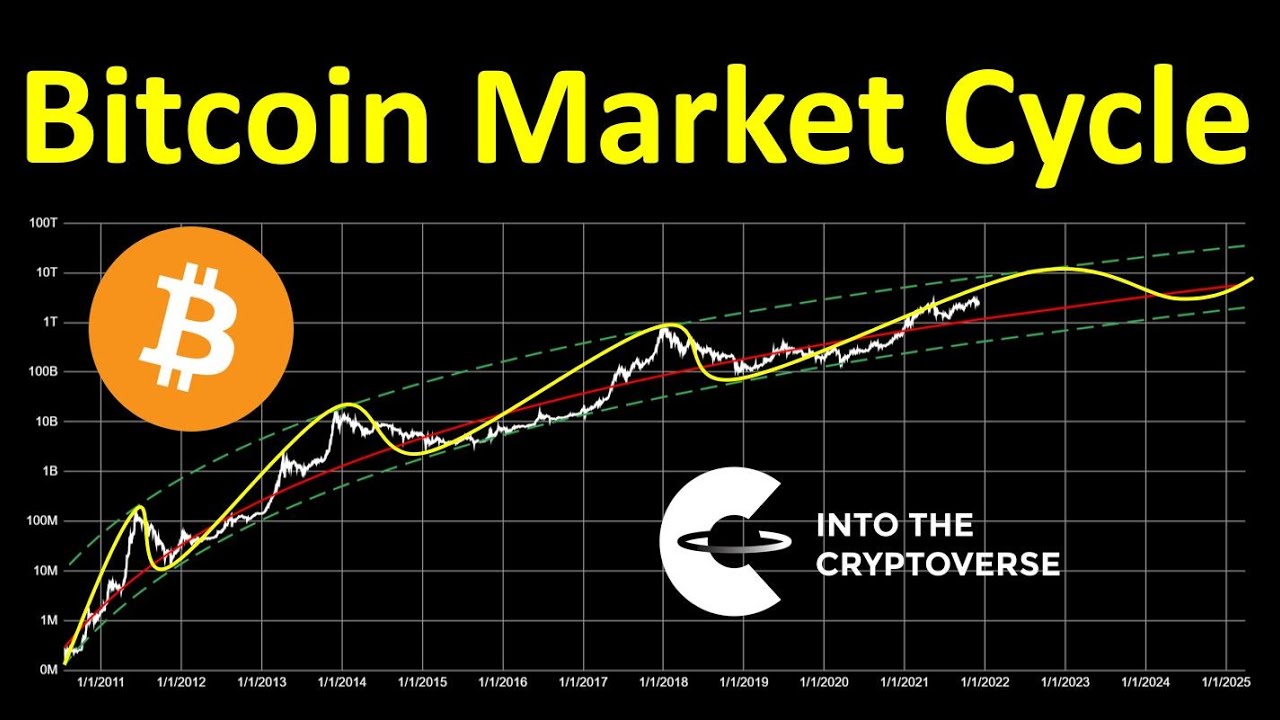

Bitcoin (BTC) has long followed a four-year cycle driven by halving events. These events, which halves miner rewards, have traditionally caused supply constraints, demand, and price spikes. However, this cycle has caused extended bear markets with steep declines. Burniske claims this pattern can be broken under certain conditions. He believes Bitcoin and the crypto market could break these cycles with a supportive regulatory and economic climate from the new U.S. administration. Goldilocks Period for Cryptocurrencies He believed this would facilitate more consistent and predictable growth. “Continue to believe there are high odds we break the simplistic four-year cycle that BTC has honored the last ~12 years,” Burniske said. Bitcoin would evolve toward widespread and institutional adoption with such a transformation.

Understanding the ‘Goldilocks Period’

The term “Goldilocks period” in financial markets refers to “just right” conditions. Sustainable economic growth, controlled inflation, and a reasonable risk-reward balance characterize this scenario. Burniske envisions a future where cryptocurrencies grow steadily without the market turbulence of the past.

Burniske says crypto investors may not expect parabolic price hikes in the near years. However, slower growth may lead to wider adoption and stronger market fundamentals. “With a supportive US administration, crypto could be entering a Goldilocks period over the next many years, where returns aren’t as parabolic, but instead we see steadier growth,” he said. Burniske believes this trend will benefit long-term investors and institutions seeking more predictable returns and reduce market speculation.

ETFs and Institutional Participation

The introduction and broad acceptance of bitcoin exchange-traded funds may drive this Goldilocks moment. ETFs for Bitcoin and Ethereum (ETH) have begun to appear, providing investors with a regulated and accessible alternative to participate in these digital commodities. Burniske thinks ETFs and other financial products will reduce market volatility.

Since ETFs follow Bitcoin and Ethereum, they create persistent buying pressure. This could stabilize pricing, especially since ETFs attract institutional investors with longer investment horizons than individual traders. “I also think BTC and ETH both having ETFs, and perhaps SOL+ soon, will provide more consistent buying pressure for these assets,” he said. ETF stabilization might also affect other major cryptocurrencies, strengthening the market. Along with a mature regulatory landscape, large price swings and panic-driven sell-offs may decrease.

Declining Boom-and-Bust Cycles

For years, the Bitcoin market has experienced severe boom-and-bust cycles. These cycles have deterred institutional investments and worried regulators and mainstream banks. Burniske predicts that the Goldilocks period will cease these dramatic cycles and replace them with more measured corrections and recoveries.

Burniske notes that Bitcoin’s 200-week SMA is $40,000. This statistic predicts a maximum bearish drawdown of 60%, which is much less severe than previous cycles’ 80%+ corrections. He said, “As BTC rises, so too will the 200-week SMA,” indicating a maturing market with lower volatility. Market volatility reduction would make cryptocurrencies more appealing to institutional investors and improve their usability as a medium of exchange and store of value.

Market Confidence and Regulation Tailwinds

The new U.S. administration is expected to address long-standing bitcoin regulation issues like compliance, taxation, and consumer protection. A clear and attractive regulatory environment could boost retail and institutional investor confidence. Burniske believes a balanced regulatory approach could spur crypto innovation. This includes blockchain integration into existing banking systems, DeFi growth, and Web3 usage.

Forward to 2025

Burniske expects 2025 to be a “great year” for cryptocurrencies. Regulatory backing, technological breakthroughs, and institutional participation laid the foundation for this transformation. He expects crypto assets to become less speculative and more important to the global financial system. Burniske believes the market can overcome problems including changing legislation and scalability. Enhanced adoption,lower volatility, and consistent growth might establish cryptocurrencies as a genuine asset class.

Read More: How to Buy Pepeto (PEPETO) A Simple Guide

Conclusion

Chris Burniske’s Goldilocks cryptocurrency market vision is optimistic. New U.S. administration backing, ETFs, and a maturing market structure might lead to more stable and sustainable development. This time of balanced growth and lower volatility could change the cryptocurrency narrative. Goldilocks Period for Cryptocurrencies Digital assets may become reliable and vital to the global financial ecosystem after leaving the speculative, high-risk environment. Investors and enthusiasts can take advantage of this Goldilocks era to join the crypto revolution.