The rapid evolution of the cryptocurrency market has turned futures trading into one of the most popular ways for traders to speculate, hedge risk, and maximize capital efficiency. As we move into 2026, competition among exchanges is no longer just about liquidity and security. One crucial factor increasingly shaping trader decisions is cost. Many traders now ask the same essential question: which crypto exchange has the lowest fees for futures trading? Understanding fee structures is critical because even small differences in trading costs can significantly affect long-term profitability, especially for high-frequency and leveraged traders.

Crypto futures trading fees are more complex than simple spot trading commissions. They often include maker and taker fees, funding rates, liquidation penalties, and sometimes hidden costs related to spreads and slippage. For beginners and professionals alike, choosing the right exchange means balancing low fees with strong infrastructure, reliability, regulatory clarity, and advanced trading tools. In this detailed 2026 guide, we explore which crypto exchange has the lowest fees for futures trading by analyzing leading platforms including Binance, Bitget, Coinbase, Kraken, and Bitfinex. This article is designed to be a comprehensive, human-written resource that explains not only raw fee numbers but also the deeper context behind them. You will learn how different crypto futures trading fees, maker and taker fees, and perpetual futures costs compare across exchanges, helping you make a more informed decision in an increasingly competitive market.

Futures Trading Fees in Crypto Markets

Before identifying which crypto exchange has the lowest fees for futures trading, it is important to understand how these fees work. Unlike spot trading, futures trading involves contracts that derive their value from underlying assets, often combined with leverage. Exchanges charge traders primarily through maker fees, taker fees, and periodic funding rates that balance long and short positions.

Maker fees apply when traders add liquidity to the order book by placing limit orders, while taker fees are charged when traders remove liquidity by executing market orders. In most cases, maker fees are lower than taker fees, and some exchanges even offer negative maker fees as incentives. Beyond these, funding rates can either add to or reduce overall trading costs depending on market conditions. This complexity means that the question of which crypto exchange has the lowest fees for futures trading cannot be answered by looking at a single number.

Binance Futures Fee Structure in 2026

Binance has long been regarded as a benchmark when discussing which crypto exchange has the lowest fees for futures trading. In 2026, Binance Futures continues to offer one of the most competitive fee structures in the industry. Standard users typically face very low maker and taker fees compared to most competitors, with additional discounts available for high-volume traders and those holding the platform’s native token.

One of Binance’s major advantages lies in its tiered fee system, which rewards active traders with progressively lower fees as their trading volume increases. This makes Binance particularly attractive for professional traders and institutions executing large orders. In addition, Binance offers deep liquidity across a wide range of perpetual futures contracts, which helps minimize slippage and indirectly reduces trading costs.

However, while Binance often leads discussions about lowest futures trading fees, traders must also consider regulatory restrictions in certain regions and the complexity of its interface. Despite these considerations, Binance remains a top contender for traders prioritizing cost efficiency in futures trading.

Bitget Futures Fees and Competitive Pricing

Bitget has emerged as a strong competitor in the race to answer which crypto exchange has the lowest fees for futures trading. In 2026, Bitget positions itself as a futures-first exchange, focusing heavily on derivatives trading and offering highly competitive maker and taker fees. Its fee structure is designed to appeal to both retail traders and professionals, with particularly attractive rates for high-frequency strategies.

Bitget’s emphasis on copy trading and social trading features also differentiates it from more traditional exchanges. While these features are not directly related to fees, they add value that can offset slightly higher costs for some users. Nevertheless, Bitget’s futures trading fees remain among the lowest in the market, especially for traders who actively use limit orders.

Another key factor is Bitget’s relatively simple fee transparency. Traders can easily understand how much they are paying per trade, which enhances trust and usability. For those exploring crypto derivatives trading platforms with low fees and modern features, Bitget is increasingly part of the conversation.

Coinbase Futures Fees and Institutional Focus

Coinbase is often associated with regulatory compliance and ease of use rather than low fees. When evaluating which crypto exchange has the lowest fees for futures trading, Coinbase usually ranks higher in cost compared to offshore platforms like Binance or Bitget. In 2026, Coinbase Futures primarily caters to institutional and professional traders in regulated markets. Coinbase’s futures fee structure reflects its compliance-heavy approach. While fees may be higher, traders benefit from strong legal protections, transparent reporting, and integration with Coinbase’s broader ecosystem. For institutional traders, these advantages can outweigh higher trading costs, particularly when managing large portfolios.

From a pure cost perspective, Coinbase is rarely the answer to which crypto exchange has the lowest fees for futures trading. However, for traders who prioritize regulatory clarity and long-term stability over minimal fees, Coinbase remains a compelling option.

Kraken Futures Fees and Reliability

Kraken has built its reputation on security, transparency, and reliability. In 2026, Kraken Futures continues to offer competitive fees, though not always the absolute lowest. Kraken’s maker and taker fees are structured to reward liquidity providers, and its fee tiers are designed to benefit traders with higher monthly volumes.

Kraken stands out for its consistent uptime and conservative risk management practices. These qualities can reduce indirect costs associated with system outages or forced liquidations during periods of extreme volatility. When asking which crypto exchange has the lowest fees for futures trading, Kraken may not always top the list numerically, but its overall cost-effectiveness can be attractive for risk-conscious traders. Kraken also appeals to traders who value transparency. Fee schedules are clearly published and easy to understand, which reduces the likelihood of unexpected costs. This reliability contributes to Kraken’s ongoing relevance in the futures trading ecosystem.

Bitfinex Futures Fees and Advanced Trading Tools

Bitfinex is well known for catering to advanced traders who require sophisticated tools and deep liquidity. In 2026, Bitfinex Futures offers competitive fees that often rival other major exchanges, particularly for high-volume traders. Its maker and taker fees are structured to incentivize liquidity provision, making it appealing for professional market participants.

One of Bitfinex’s strengths is its advanced order types and customization options. These tools can help traders optimize execution and reduce slippage, indirectly lowering overall trading costs. While Bitfinex may not always be the definitive answer to which crypto exchange has the lowest fees for futures trading, it remains a strong contender for experienced traders who value flexibility and control. However, Bitfinex’s interface and features may be overwhelming for beginners. For traders comfortable with complexity, the combination of competitive fees and advanced functionality makes Bitfinex a compelling choice.

Comparing Which Crypto Exchange Has the Lowest Fees for Futures Trading

When directly comparing Binance, Bitget, Coinbase, Kraken, and Bitfinex, it becomes clear that there is no single universal answer to which crypto exchange has the lowest fees for futures trading. Binance and Bitget generally lead in terms of raw fee competitiveness, especially for retail and high-frequency traders. Kraken and Bitfinex offer balanced approaches that combine reasonable fees with strong infrastructure, while Coinbase prioritizes compliance over cost minimization. The best choice ultimately depends on trading style, volume, jurisdiction, and risk tolerance. Traders focused solely on minimizing futures trading costs may gravitate toward Binance or Bitget. Those who value regulatory oversight and institutional-grade services may prefer Coinbase despite higher fees. Understanding these nuances is essential for making a strategic decision in 2026.

Hidden Costs Beyond Trading Fees

While fee schedules are important, they are not the only factor influencing overall trading costs. Funding rates, liquidation mechanisms, and platform performance can all impact profitability. An exchange with slightly higher fees but better liquidity and stability may be more cost-effective in practice than one with the absolute lowest advertised rates.

This is why the question of which crypto exchange has the lowest fees for futures trading should always be considered in a broader context. Traders who ignore hidden costs may find that their actual expenses exceed expectations, regardless of low headline fees.

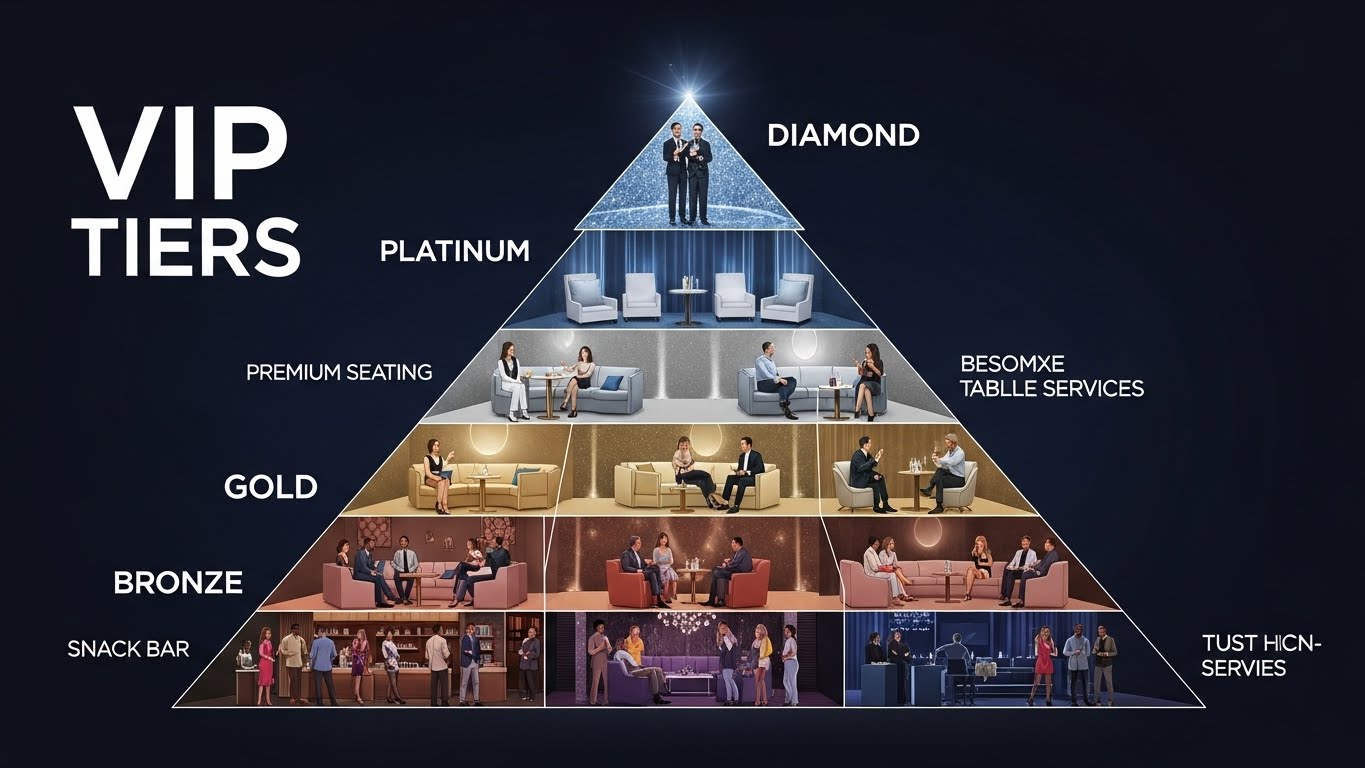

The Role of Volume Discounts and VIP Tiers

Most major exchanges now offer tiered fee structures that reward high-volume traders. These VIP programs can significantly reduce costs, sometimes making an exchange with average base fees more competitive at scale. For professional traders, evaluating which crypto exchange has the lowest fees for futures trading often requires analyzing these volume-based discounts. Binance, Bitget, Kraken, and Bitfinex all offer such programs, while Coinbase’s institutional pricing can vary based on negotiated terms. For active traders, these discounts can make a substantial difference in long-term profitability.

Conclusion

As the crypto market matures in 2026, the competition among exchanges continues to intensify. The question of which crypto exchange has the lowest fees for futures trading does not have a one-size-fits-all answer. Binance and Bitget generally offer the lowest headline fees, making them attractive for cost-focused traders. Kraken and Bitfinex provide a balance of competitive pricing, reliability, and advanced tools, while Coinbase emphasizes regulatory compliance and institutional trust over minimal fees. Ultimately, the best exchange is the one that aligns with your trading strategy, volume, and risk preferences. By understanding not only fee structures but also the broader trading environment, you can make a more informed decision and optimize your futures trading performance in 2026.

FAQs

Q: Which crypto exchange has the lowest fees for futures trading for beginners in 2026

For beginners, the exchange with the lowest fees for futures trading is often one that combines low taker fees with an intuitive interface and educational support. Binance and Bitget are frequently considered strong options because they offer low entry-level fees and deep liquidity, which helps beginners avoid excessive slippage. However, beginners should also consider user experience and risk management tools, as extremely low fees alone do not guarantee a positive trading experience.

Q: Which crypto exchange has the lowest fees for futures trading for high-volume traders

High-volume traders often find that Binance or Bitget offers the lowest fees for futures trading due to aggressive VIP tier discounts. These exchanges reward large monthly trading volumes with significantly reduced maker and taker fees, sometimes making costs negligible compared to competitors. Bitfinex can also be competitive at high volumes, especially for traders who provide liquidity consistently.

Q: Which crypto exchange has the lowest fees for futures trading when funding rates are considered

When funding rates are included, the answer to which crypto exchange has the lowest fees for futures trading can change depending on market conditions. Exchanges with large user bases and balanced order books, such as Binance, often maintain more stable funding rates. This stability can reduce overall costs compared to platforms where funding rates fluctuate more aggressively.

Q: Which crypto exchange has the lowest fees for futures trading in regulated markets

In regulated markets, Coinbase and Kraken are among the most prominent options, but they do not usually have the lowest fees. While Coinbase offers strong compliance and institutional-grade services, its futures trading fees are generally higher than offshore exchanges. Kraken provides a middle ground, offering reasonable fees alongside regulatory transparency, making it a practical choice for traders who prioritize compliance.

Q: Which crypto exchange has the lowest fees for futures trading in the long term

Over the long term, the exchange with the lowest fees for futures trading depends on trading behavior and volume growth. Traders who increase their activity over time may benefit most from exchanges with scalable fee discounts like Binance or Bitget. However, long-term success also depends on platform reliability, liquidity, and risk controls, all of which contribute to the true cost of futures trading beyond simple fee percentages.